Aug 13, 2019

CBS and Viacom Reunite Just in Time for a Media Fight

, Bloomberg News

(Bloomberg Opinion) -- The road to a merger of CBS Corp. and Viacom Inc. was winding and treacherous, featuring boardroom clashes, legal battles and a #MeToo moment. But on Tuesday, after years of friction and back-and-forth, the two Hollywood companies officially agreed to reunite. It’s about time.

CBS is buying Viacom in an all-stock deal that values the company at about $18.5 billion including debt, formalizing a plan their controlling shareholder, Shari Redstone, has long pursued. The terms involve CBS exchanging 0.59625 a share for each Viacom share, and the new entity will be called ViacomCBS. The transaction puts CBS, the broadcaster, and Showtime, a premium cable channel, back under the same roof as Viacom’s networks, such as MTV, BET, Nickelodeon and Comedy Central, as well as the Paramount Pictures movie studio.

Fourteen years ago, these businesses formed a single company. The endless melodrama that’s revolved around CBS and Viacom ever since provides important context in understanding why they need each other now.

Beginning in the late 1980s, Shari Redstone’s father, the movie-theater mogul Sumner Redstone, spent what would normally be one’s retirement years snapping up media assets. Then, in 2006, he split his conglomerate in two. The reasons were just as ego-driven as they were business-minded, giving each of his two favorite successor candidates a company to run: Les Moonves with CBS and Showtime on one side and Tom Freston with Viacom and Paramount on the other. An elated Moonves said the move would resolve an internal “schizophrenia,” but it spawned a corporate-sibling rivalry. It wasn’t long before Redstone fired Freston (bizarrely, for not taking over the website MySpace), and Philippe Dauman was chosen as the next Viacom CEO, the one who would oversee its vicissitudes of fortune.

Redstone called Dauman “the wisest man I have ever known.” He would often say Moonves was a “super genius.” He was wrong on both accounts. Under Dauman, Viacom’s cable networks lost popularity, and the movie business suffered steep losses, greenlighting small films with unjustifiably big budgets. CBS was the stronger sibling, and Moonves was considered especially skilled at crafting its programming lineup. However, Moonves was accused of abusing his power, fostering a culture of sexism, harassment and intimidation. Dauman was ousted in 2016; the #MeToo movement ushered Moonves out two years later.

Since then, Viacom has been staging a turnaround under CEO Bob Bakish, who will remain in his role as chief of the combined entity, working to deliver on the annual $500 million of promised cost savings. Shari Redstone, who stepped into her father’s shoes some time ago, will be the new chair of the board. Joe Ianniello, Moonves’s former No. 2 and interim successor, has worked to get back into Redstone’s good graces after CBS’s suit last year to strip her of her voting power. He will stay on as chairman and CEO of the CBS business, reporting to Bakish. It’s not the juicy ending fans of HBO’s “Succession” — a TV series partly inspired by the Redstones and other media moguls — would want or expect from CBS and Viacom, but it’s the civilized outcome the companies need so they can fight to stay relevant in their industry.

Bakish’s track record makes him a solid pick to lead that charge, or perhaps dress up the new entity for a sale. A roll-up-your-sleeves-type manager, he’s injected life back into Viacom after many investors thought it was too far gone. He’s reduced the debt that was once a serious strain on the business, and he’s invested in growth opportunities, such as the advertising-supported Pluto TV streaming service. Paramount Pictures is making money again.

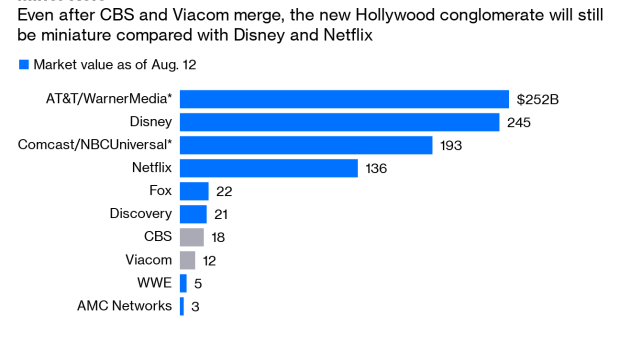

Still, the years of dysfunction did its damage, and CBS and Viacom’s rivals only got bigger. Walt Disney Co. purchased the 20th Century Fox studio and other assets from Rupert Murdoch for $85 billion this year. That deal came on the heels of AT&T Inc.’s $102 billion takeover of Time Warner, the parent of HBO.(1) Discovery Inc. now owns former Scripps properties such as HGTV. Netflix Inc., meanwhile, has grown its global subscriber base to more than 150 million. My column last week explained in more detail why CBS and Viacom would benefit from greater scale, which saves them money and provides greater ability to negotiate with pay-TV operators and devise a more tenable streaming strategy.

A combined CBS-Viacom may even be a merger candidate for Discovery next. There are similarities: Like Viacom, Discovery focuses on unscripted programming — or reality TV — and it’s controlled by a billionaire, John Malone, who at 78 is thinking about how to tidy up his estate. As owners of the also-rans of the industry, it may be time for Redstone and Malone to work out a deal. Starz, the premium channel owned by Lions Gate Entertainment Corp., another Malone investment, is an option as well.

Sumner Redstone turned 96 in May and was deemed incapacitated by a judge last year amid litigation involving his trust. He is said to communicate using iPad prompts, including one that curses on his behalf; only those closest to the ailing billionaire know what button he pressed when he heard about the merger. But in April 2008, when Redstone was still able to participate in earnings calls, he said this:

I think that Les [Moonves]'s strategy will work for CBS, and I think that Philippe [Dauman]'s strategy will work for Viacom. It is not true that success between these two companies is mutually exclusive.

The irony is that his misplaced faith in those managers is why CBS and Viacom’s fates are intertwined once again.

(1) Transaction values include debt.

To contact the author of this story: Tara Lachapelle at tlachapelle@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tara Lachapelle is a Bloomberg Opinion columnist covering deals, Berkshire Hathaway Inc., media and telecommunications. She previously wrote an M&A column for Bloomberg News.

©2019 Bloomberg L.P.