May 23, 2019

CBS Is Preparing to Survive in Netflix’s World

, Bloomberg News

(Bloomberg Opinion) -- CBS Corp. is trying to rebuild a Hollywood empire – and in the process may end up creating the industry’s next and final big takeover candidate.

The broadcast network is said to have made a $5 billion bid for Starz, a cable channel owned by the film-making company Lions Gate Entertainment Corp., which is set to report earnings for its latest quarter after the close of trading on Thursday. While the offer was rejected as too low, CBS is reportedly still interested in working out a deal. But that’s not the only transaction on its agenda.

CBS is also likely inching closer to a recombination with Viacom Inc., a company with which CBS shares its controlling investor, Shari Redstone, 65. She’s the daughter of ailing media mogul Sumner Redstone, who decades ago, through many a battle, began taking over media and entertainment assets – MTV’s parent, Paramount Pictures, CBS – and later in 2005 split them into the two entities, which today are valued at about $30 billion combined. He turns 96 next week. Repackaging his businesses and selling them may be the final chapter.

For a company still technically without a permanent chief executive, CBS sure is keeping busy. It’s been led by acting CEO Joseph Ianniello since September, when its longtime leader and face of the company, Leslie Moonves, was ousted following numerous sexual-harassment allegations. In terms of his reach of power and his wealth, Moonves became perhaps the largest take-down of the #MeToo movement. And his departure cleared the way for this round of Redstone dealmaking.

The three biggest questions are: Why Starz? Why is Lions Gate potentially selling something it bought less than three years ago? And who is going to manage all these assets for the Redstones?

One would think that CBS has its hands full with Viacom, a deal that’s had a number of false starts in recent years and produced more drama than anything on their TV networks. But Shari Redstone knows that what CBS needs most of all in an industry increasingly dominated by Netflix Inc., Amazon.com Inc., Walt Disney Co. and AT&T Inc. is greater scale. Viacom brings with it a young and diverse audience through its MTV, Comedy Central, Nickelodeon, BET and CMT networks. It’s also been reviving the Paramount film-studio business, something CBS doesn’t have, and Viacom recently acquired Pluto, a free ad-driven video-streaming platform. There would be a lot of cost synergies. And Viacom has a well-liked CEO, Bob Bakish, 55, who has steered the company through a turnaround that many didn’t think possible.

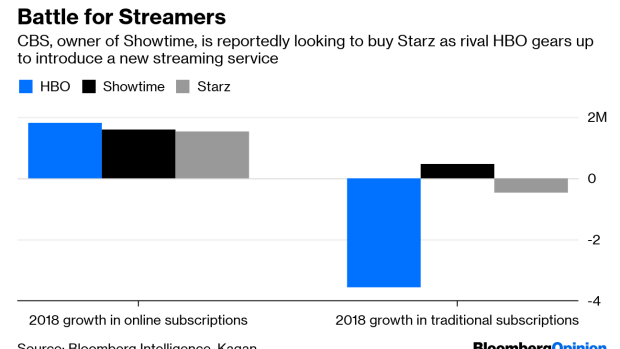

As for Starz, it’s more of a natural complement for CBS, which owns Showtime. Together, Showtime and Starz could be a more formidable rival to HBO, which its new parent AT&T is building a new streaming service around. Starz has been holding up quite well amid the wave of cord-cutting, with its show “Power” drawing a larger audience than Showtime’s “Billions,” “Ray Donovan” and other series. The $8.99-a-month Starz streaming app also has more than 3 million subscribers, adding to the 8 million users of the CBS All Access and Showtime apps.

While Starz and Showtime may be thought of as premium movie channels, they’re benefiting from a surge in appetite for original series, rather than films that are costlier to procure. CBS said earlier this month that originals account for more than 80% of consumption on the Showtime app. That presents CBS and Starz with a way to reduce churn, or the rate at which customers cancel or pause their subscriptions. It’s something all the media companies will grapple with – HBO right now especially because “Game of Thrones” has ended – given the relative ease of quitting a streaming app.

Starz is carried on Lions Gate’s balance sheet at a value of $4.9 billion. According to Alan Gould, an analyst for Loop Capital Markets, Starz’s domestic business is worth about $4.5 billion, and its international opportunities could be another $1 billion. That may give an idea of how much CBS needs to offer.

The partnership between Lions Gate and Starz hasn’t been all that successful to date. This summer “The Rook,” a supernatural spy thriller, will be the first Lions Gate TV production made for Starz – again, nearly three years after their merger. Meanwhile, Lions Gate’s movie business hasn’t impressed lately. Its biggest film of 2018 in the U.S. was “A Simple Favor,” which ranked 53rd in the box office. However, the third “John Wick” installment shows promise, having brought in $56.8 million in its opening last weekend.

Starz’s growth has supported Lions Gate’s stock price. So to sell Starz would likely mean to seek a buyer for Lions Gate, too. Billionaire John Malone, 78, is the second-largest holder of Lions Gate’s voting shares, and I’ve written that he seems to be trying to tidy up his sprawling set of media, sports and entertainment holdings. It’s possible that CBS could just buy all of Lions Gate, combining the film studio with Viacom’s Paramount. Another oft-speculated merger candidate for Lions Gate is the closely held MGM.

As for CBS, there’s strong strategic rationale for both the Viacom and Starz deals, which would make it both a stronger player in content and a more attractive target in its own right. That said, CBS should see if it can finally get one transaction done first, because even that’s proven difficult.

To contact the author of this story: Tara Lachapelle at tlachapelle@bloomberg.net

To contact the editor responsible for this story: Beth Williams at bewilliams@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tara Lachapelle is a Bloomberg Opinion columnist covering deals, Berkshire Hathaway Inc., media and telecommunications. She previously wrote an M&A column for Bloomberg News.

©2019 Bloomberg L.P.