Aug 17, 2022

Cedi Set for Worst Weekly Drop Since 2019 as Ghana Decides Rates

, Bloomberg News

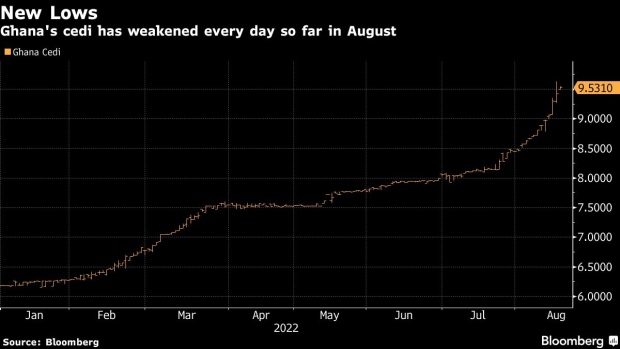

(Bloomberg) -- Ghana’s currency extended its decline Wednesday, heading for its worst weekly drop in more than three years before an emergency central bank meeting to decide on borrowing costs.

The cedi dropped 1.1% at 11:03 a.m. in Accra, extending its fall this week to 5.2%. That’s the worst decline since the seven-day period ending March 29, 2019. The measure has plunged 35% this year making it the world’s worst-performing currency after Sri Lanka’s rupee among 150 economies tracked by Bloomberg.

As the monetary policy committee met, a new set of data showed that inflation may accelerate further in the coming months. Ghana’s producer prices in July jumped 41.2%, the fastest pace in eight years. The worsening economic situation may spur the central bank to raise its policy rate by 200 basis points to 21% Wednesday, according to predictions by economists at Goldman Sachs Group Inc.

There’s a “meaningful upside risk to this forecast, given the extent of FX and domestic financing pressures,” Goldman Sachs economists, Bojosi Morule and Andrew Matheny, said in a note to clients on Tuesday.

Ghana approached the International Monetary Fund for a loan earlier this year following the cedi’s incessant depreciation and accelerating inflation.

The emergency meeting comes after regulators in Ghana announced Monday that water and electricity tariffs will rise 22% and 27% respectively starting next month. Those increases will add to the deteriorating inflation outlook in Ghana, said Absa Group Ltd. analyst Ridle Markus.

The Bank of Ghana is the second in sub-Saharan Africa after the Bank of Uganda to hold an emergency meeting since Russia’s war with Ukraine erupted in February.

(Adds producer prices in third paragraph.)

©2022 Bloomberg L.P.