Jun 16, 2020

Central Banks Have Put a Floor Under European Equity Markets

, Bloomberg News

(Bloomberg) --

Volatility has returned to European equities, but a week of selling doesn’t necessarily mean the market might revisit March lows.

Dire economic data and worries about potential second wave of Covid-19 infections fueled the Stoxx Europe 600 Index’s worst drop since the March turmoil last week. However, unprecedented fiscal and monetary stimulus, coupled with global asset managers’ low position in European shares over the past years, can serve as a cushion against stronger losses.

“The market could go sideways for a bit or fall a bit, but it’s definitely not going to be back to levels that we saw in mid-March,” said Suzanne Hutchins, a portfolio manager on the real return team at Newton Investment Management Ltd. Central bankers are acting as a backstop, “a put” to the market, because they buy the assets that everyone else wants to buy, forcing investors to take risk, and the excess liquidity means equities could go higher, she said.

For a long time, global investors stayed away from European stocks, spooked by political instability and the overall lack of real economic and earnings growth. But over the past month, they’ve been using their dry powder to buy euro-area shares among other things, according to a survey from Bank of America Corp. released on Tuesday.

Allocation to the region’s equities surged 24 percentage points to a net 7% overweight, the largest increase in net weighting of any region this month, BofA said.

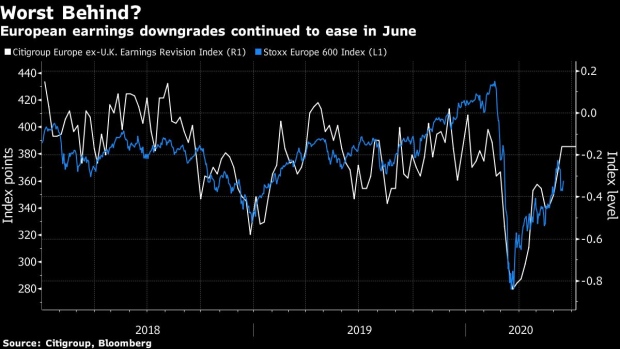

The bounce in the market since the March lows is also a reflection of a less pessimistic view of future earnings by analysts, as shown by Citigroup’s earnings revision Index. Although still negative, the index has bounced back and is not far from turning positive.

Still, without a real rebound in earnings expectations, price-to-earnings valuation ratios will remain high, which could prevent a number of investors from chasing stocks higher at these levels. Meanwhile, analysts may wait to hear from companies in the next earnings season before revising their forecasts.

“The equity market is pretty fully valued now, (but) I wouldn’t say it’s gone way too far,” Newton’s Hutchins said.

Doubts are also emerging about the ability of central banks to provide further support from here, making the speed of the economic recovery the big catalyst for financial markets looking forward.

“With more limited scope by central banks, pricing of growth will remain the main driver of cross-asset performance, and recent market weakness suggests investors have reassessed lower their expectations on the recovery,” Goldman Sachs Group Inc. strategist Alessio Rizzi wrote in a note on Monday, adding the recent stock market correction was “healthy” for risk appetite.

©2020 Bloomberg L.P.