Mar 24, 2022

Central Banks Must Add Biodiversity to Financial Stability Risks

, Bloomberg News

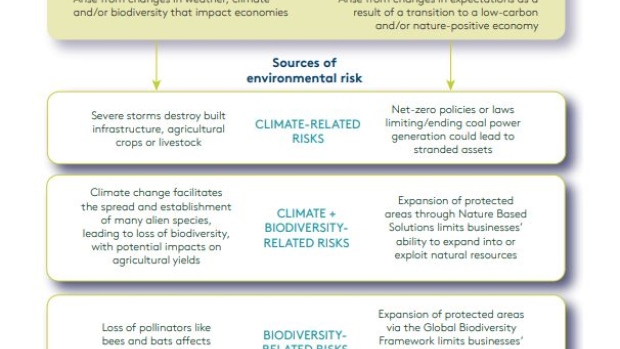

(Bloomberg) -- Biodiversity loss poses a “significant and under-appreciated” threat to financial stability and its status needs to be elevated by regulators, according to a study by central bankers, financial supervisors and academics.

It’s “potentially as economically and financially impactful as climate change,” said Nick Robins, co-chair of the study group and a professor at the London School of Economics. The report shows that the twin threats now need to be “tackled in a joined-up way by central banks and supervisors.”

The report, which provides the first global assessment of why and how central banks and supervisors can respond to rising risks from biodiversity loss, makes five recommendations for central banks and financial regulators:

- Recognize biodiversity loss as a potential source of economic and financial risk;

- Build the skills and capacity to analyze and address these risks;

- Assess the degree to which financial systems are exposed to biodiversity loss;

- Explore options for supervisory actions to manage biodiversity-related risks and minimise negative impacts on ecosystems; and

- Help to build the necessary financial architecture for mobilizing investment that helps to conserve biodiversity

The study is co-authored by a special group set up by the Central Banks and Supervisors’ Network for Greening the Financial System (NGFS) and INSPIRE, an independent research network. It consisted of more than 100 central bankers, supervisors and researchers.

Why Big Central Banks Are Becoming Climate Warriors: QuickTake

The report also sets out a research agenda for central banks and academics to continue to address some of the analytical and data gaps identified.

Global central banks have been stepping up efforts to combat climate change, with former Bank of England Governor Mark Carney in 2015 raising the alarm about the “tragedy” and warning specifically about “re-pricing” events.

“Biodiversity loss could have significant macroeconomic implications,” said Ravi Menon, managing director of the Monetary Authority of Singapore and chair of the NGFS. “Failure to account for, mitigate, and adapt to these implications is a source of risks.”

©2022 Bloomberg L.P.