Jul 19, 2019

Central Banks See Here a Cut, There a Cut, Everywhere a Cut, Cut

, Bloomberg News

(Bloomberg) -- Trade-war jitters and slower growth are prompting more interest-rate cuts by spooked central bankers, who are already feeling under pressure with little help from governments.

Here’s our weekly wrap of what’s going on in the world economy.

It’s a Dove’s World

The dovish wave sweeps on. South Korea surprised with a rate cut on Thursday, feeling the pressure of slumping exports and tensions with Japan. The same day, Indonesia lowered its benchmark for the first time in almost two years and pledged more easing to come. South Africa joined in with a rate reduction after sharply cutting its forecast for economic growth and Ukraine also followed suit.

The Bank of England saw U.K. inflation stick to its sweet spot of 2%, and an uptick in wage growth that would suggest tightening in a different backdrop. But they are hemmed in by Brexit for now.

Two Federal Reserve bigwigs stressed the need for quick action to support growth in speeches Thursday, exciting investors betting on a Fed cut of as much as half a percentage point later this month.

To help sort it all out, here’s our updated guide to what the world’s top central banks will do next.

Read More:

- What Wall Street Banks Say About Fed Rate Cuts This Year

- What Africa’s Key Central Banks Will Discuss in the Next 10 Days

Shrinking Toolbox

Even as interest-rate cuts make the big headlines, central bankers are wary that it won’t be enough. They’re sick of having to go it alone, and Group of Seven finance ministers are getting an earful about loosening purse strings to aid the effort.

Thai policy makers, among others, are arguing for a focus on other tools even as their currency surges. Even Turkey’s politically installed central bank chief pledged not to rely too much on interest-rate easing.

Pimco is warning that with all the complications around managing the flows, a currency war can’t be ruled out. It’s already a tough time to be a central banker, and Jerome Powell feels this all too well, as Chris Condon profiles in Bloomberg Businessweek’s cover story.

Read More:

- ECB Studies Revamping Inflation Goal in Twilight of Draghi Era

- EURO-AREA INSIGHT: Three Economic Shocks to Trouble Draghi

- Central Banks Launch Growth Mission With Arsenals Questioned

Trade Tremors

No good (trade) news goes unpunished. While top U.S. officials signaled they’d chat this week with their Chinese counterparts as a gateway to a potential Beijing visit, “Tariff Man” reiterated the U.S. has room to apply more levies on China. It was a reminder that President Donald Trump will do everything to ensure the U.S. doesn’t appear to be softening -- even in a week when China showed more vulnerability, posting the weakest growth on record.

Trade-war contagion remains widespread: Europe is on edge as it awaits a World Trade Organization ruling that could accelerate U.S. tariffs as retribution for illegal aircraft subsidies. Japan is keeping a hard line as it maintains export curbs of its own in a fresh flare-up with South Korea. And in the data, Japan and Singapore joined a spate of Asian economies seeing deepening export slumps.

Read More:

- WTO Issues Mixed Ruling Over U.S. Duties for Cheap Chinese Goods

- Trump and Xi Are Struggling to Find Path Forward in Trade Talks

Decent for U.S., Soft for Rest

While American data haven’t been roundly solid -- and housing showed some weakness in a report this week -- plenty of reassuring signs remain. Retail sales and factory output were solid in June, the Fed’s Beige Book sees a “generally positive” outlook, and Goldman Sachs reckons growth could be underestimated by as much as a full point.

Elsewhere, North Korea is in its worst downturn since the 1990s, Russia is seeing no break in its slide, and investors are pretty glum about Germany. Hong Kong, meanwhile, is seeing economic stress from ongoing protests.

Read More:

- Unprepared U.K. Facing Highest Risk of Recession Since 2007

- Pelosi, Mnuchin Speak Again on Debt Limit as Time Runs Short

Weekend Reading & Listening

- The View From Paris: How President Macron Survived Les Gilets Jaunes (Stephanomics podcast)

- Europe Dived Into Negative Rates and Now It Can’t Find a Way Out

- BOE Policy Makers’ Case for Rate Hikes Gets Thin as Doubts Grow

- Canada, New Zealand Show Signs of Housing Bubble, Says Study

- Father of Brazil’s Inflation Targets Wants to Change the System

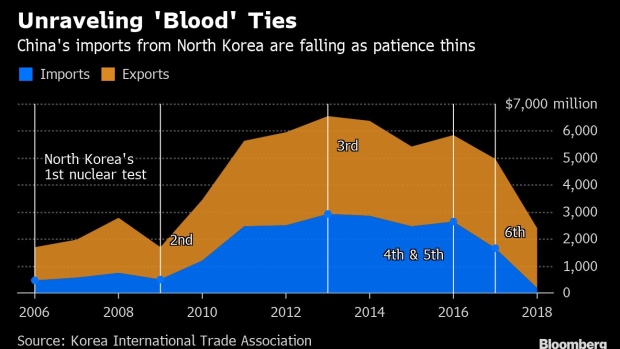

Chart of the Week

(Updates with Fed speeches in third paragraph under ‘It’s a Dove’s World’.)

To contact the reporter on this story: Michelle Jamrisko in Singapore at mjamrisko@bloomberg.net

To contact the editors responsible for this story: Simon Kennedy at skennedy4@bloomberg.net, Fergal O'Brien, Zoe Schneeweiss

©2019 Bloomberg L.P.