Apr 17, 2023

Central Banks Will Stomach Higher Inflation, Investors Tell BofA

, Bloomberg News

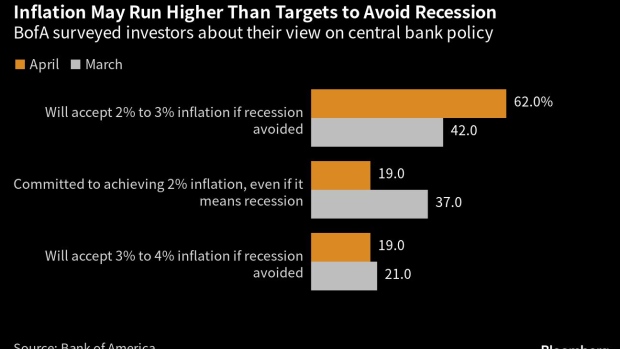

(Bloomberg) -- Central banks will settle for inflation that’s higher than their 2% targets, according to a majority of fixed-income investors in a Bank of America Corp. survey.

Nearly two-thirds of respondents in an April survey said policymakers will accept price growth of 2% to 3% if it means avoiding recession, compared to 42% in a March poll. Nearly a fifth thought they’ll stomach even higher inflation of 3% to 4%.

The findings suggest that bond investors are re-evaluating the path for markets after recent turmoil in the banking sector, according to Ralf Preusser and Myria Kyriacou, strategists at the US bank.

“Investors are concerned that inflation could not just remain sticky, but that central banks could be forced to accept higher inflation going forward,” Preusser and Kyriacou wrote in a note published Monday.

Inflation surged in the wake of the pandemic and war in Ukraine, prompting policymakers around the world to embark on one of the most aggressive interest-rate hiking cycles in history. But while headline inflation data is now broadly falling, core measures that strip out energy and food are proving harder to bring to heel.

Just 19% of respondents see central banks pursuing 2% inflation at all costs, around half the level in March. BofA conducted the survey between April 7 to 13 and received answers from 69 global fixed-income fund managers.

US Core Inflation Slows Only a Bit, Keeping Fed on Track to Hike

While markets have calmed down since the failure of three US banks and the rescue of Credit Suisse Group AG last month, respondents to the survey saw financial stability and sticky inflation as the joint biggest threats.

Developed market sovereign bonds are expected to be the best-performing asset class over the next three to six months, followed by cash, retaining their lead from the previous survey. That’s in line with expectations that a potential US recession will force the Federal Reserve to cut rates this year.

©2023 Bloomberg L.P.