Aug 15, 2022

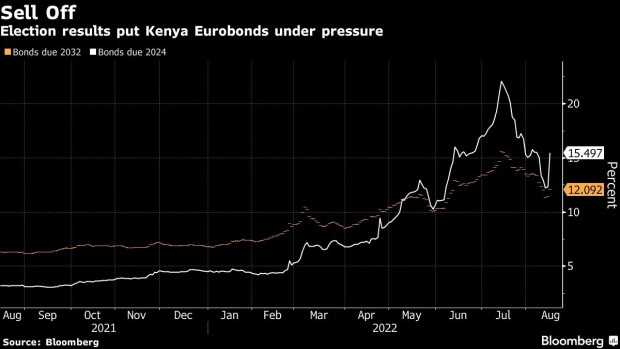

Chaos Before Kenya’s Election Results Triggers Eurobonds Sell Off

, Bloomberg News

(Bloomberg) -- Kenya’s Eurobond yields surged as a scuffle broke out at the nation’s vote tallying center before the electoral agency declared William Ruto winner of the Aug. 9 presidential election.

The yield on dollar bonds maturing in 2024 jumped 336 basis points to 15.508%, while the ones due in 2032 rose 65 basis points to 12.074% by 9:26 p.m. in the capital, Nairobi.

Yields on the bonds have been rising since Friday, but the pressure intensified after four of seven commissioners at Kenya’s Independent Electoral and Boundaries Commission on Monday questioned the vote outcome, saying the final phase of the process had been “opaque.” Bond yields climbed even though Ruto had assured investors before the vote that, unlike his rival Raila Odinga, he had no plans to restructure debt.

“Rather than bringing calm to Kenya’s financial markets, the announcement has put the country’s bond market under pressure,” Capital Economics said in a note to clients.

Investors would be skittish given Kenya’s history of electoral violence and allegations of vote-rigging, according to Capital Economics. More than 1,100 people were killed in bloody violence that followed an election in 2007 elections. Presidential contender Odinga, who lost by a narrow margin, is widely expected to appeal the outcome in Kenya’s Supreme Court.

READ: Ruto Declared Kenya President-Elect as Officials Dispute Outcome

“International concerns about violent electoral clashes have proved unwarranted so far, but social tensions are historically at their peak when the winner is announced,” said Benjamin Hunter, Africa analyst at Verisk Maplecroft. “Investors will be watching closely to see if outrage from Odinga’s followers upends the atmosphere of peace.”

©2022 Bloomberg L.P.