Jul 15, 2022

Chaos is becoming the rational base case in market ruled by fear

, Bloomberg News

I would love to see more fear in the marketplace: Invesco’s Talley Leger

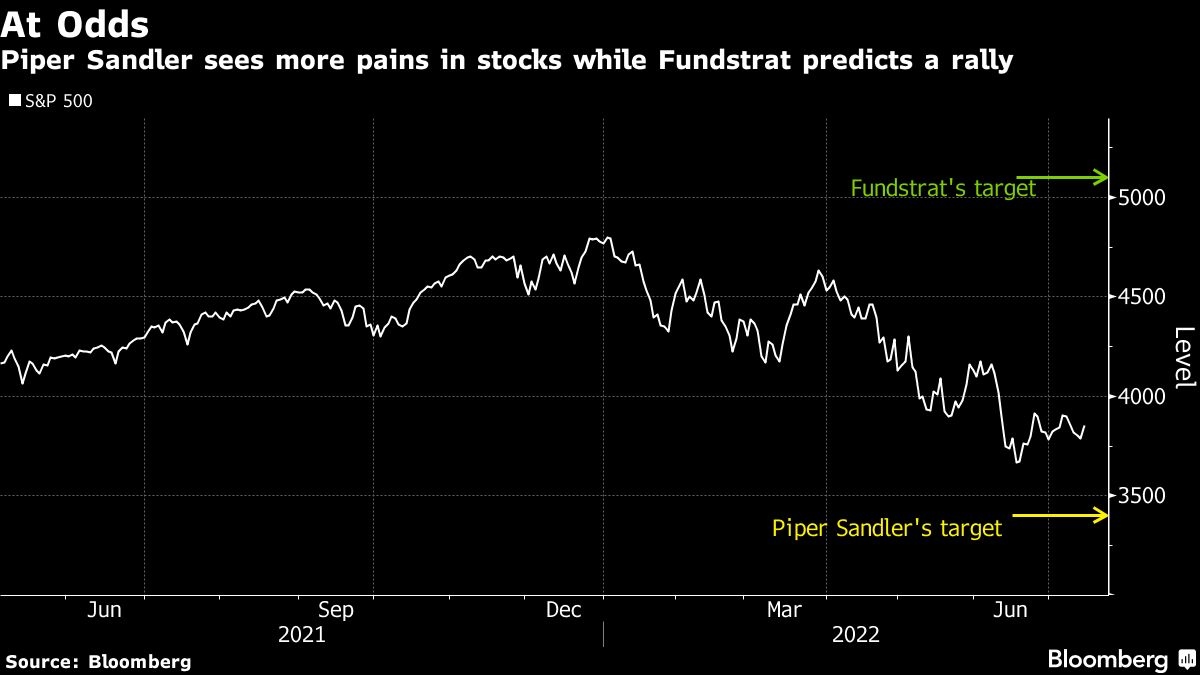

Ask paid stock forecasters what the market will do next, and the answers aren’t reassuring. Anything from plunge 12 per cent to jump 32 per cent, say S&P 500 strategists tracked by Bloomberg, among the widest ranges on record.

Such a breadth of outcomes is, to state the obvious, useless for anyone trying to form an investment case. But given the number of variables facing investors right now, it’s probably also appropriate.

Stocks keep showing the futility of trying to predict what they’ll do. Friday’s 1.9 per cent surge in the S&P 500 only served to pare its five-session loss to 0.9 per cent, extending a streak of oscillations in which equities have now alternated up-and-down weeks for a month. The index has swung more than 5 per cent in four of the last eight weeks, ending almost precisely where it began.

Getting calls right on things that influence prices is no easier. Consider a stock analyst trying to pinpoint earnings in 2023. Such an estimate requires a view on a multitude of major variables, including the impact of rising prices on sales, expenses and demand, as well as the effects of Federal Reserve rate hikes on the economy and its own future policy. It’s an exacta bet of intractable hopelessness.

“Forecasting the level of the broad market at a point in the future is always very difficult, but is especially so now given how uncertain the incoming data and, as a result, the stance of monetary policy is,” said Dean Curnutt, founder of Macro Risk Advisors. “Investors are better served to think about future outcomes from a distribution perspective, based on whether identified risks do or do not materialize.”

Market volatility was whipped up anew this week by factors encompassing everything from the hottest inflation in decades to policy opinions from Fed officials and big bank earnings. Stocks fell in each of the first four sessions, only to snap back on the last day. The Nasdaq 100 also slipped for a second week in four, staging violent upside reversals on Wednesday and Thursday.

If the wide range of outcomes foreseen by strategists helps with anything, it’s highlighting how little can be known with confidence in the market and economy right now. After uniformly failing to predict this year’s bear market, the process of rolling back optimistic predictions has been slow and messy -- befitting a market that while falling as much as 24 per cent has staged four separate bounces of 5 per cent or more.

Among strategists that rushed to downgrade their outlook is Piper Sandler & Co.’s Michael Kantrowitz, who now expects stocks to decline through December. Citing the risk of an economic recession, he cut his projection to 3,400, the lowest of all.

But the bull case lives at other firms where analysts cling to hopes the economy can avoid a recession should the Fed successfully rein in inflation and profits rise. The highest year-end target for the S&P 500 is 5,100 from Tom Lee at Fundstrat Global Advisors.

“If the economy avoids a recession, then history suggests the bear is close to over,” said Ed Clissold, the chief U.S. strategist at Ned Davis Research who forecast the S&P 500 to end the year at 4,400, about 14 per cent higher than it is now. “If the economy falls into a recession, then there is significant downside risk in both time and price.”

Professional handicappers are of course far from alone in being baffled by the post-pandemic world. Business leaders close to the ground have struggled to get a handle on everything from snarled supply chains to consumer spending habits.

An over-stocking of goods and rising costs prompted retailer giants like Target Corp. and Walmart Inc. to issue profit warnings. Peloton Interactive Inc., a darling stock during Covid lockdowns, said it will stop building its bikes and treadmills at its own factories as growth slowed. Amazon.com Inc., which doubled its warehouse capacity during the pandemic when stay-at-home orders supercharged demand, is now seeking to sublease space.

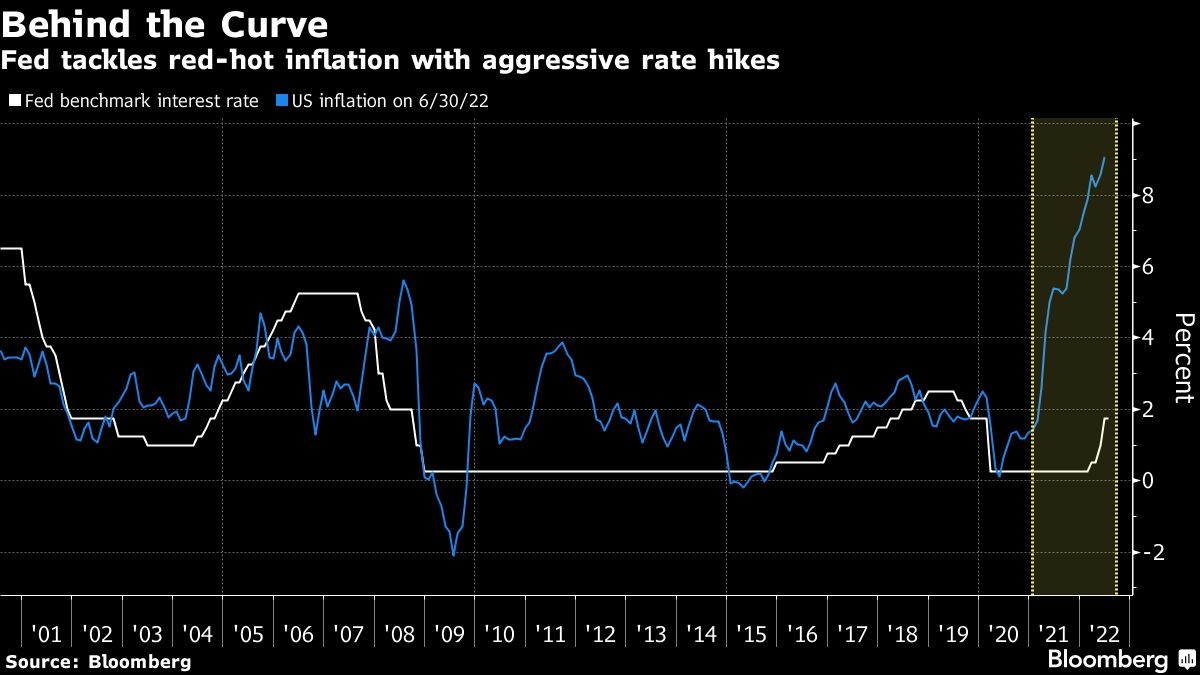

Nor did the Fed have a clue what would happen, as evidenced by the onset of 75-basis-point rate hikes. After misjudging inflation as “transitory,” the central bank has been forced to hasten the pace of tightening. Policy makers may debate a historic one percentage-point rate hike later this month after another surprisingly hot inflation report for June.

“We are at a time of fundamental change in the cost and availability of money -- the main input for financial markets,” said Steve Sosnick, chief strategist at Interactive Brokers. “So the lack of clarity about the path of the economy, rate hikes and quantitative tightening certainly contribute to the variance in forecasts.”

Confusing as all the projections are, the fluid situation opens the door for investors to put their own value-added insights to work. With share dispersion widening and the reporting season in full swing over coming weeks, opportunities theoretically abound for anyone bold enough to dive in. While the S&P 500 has lost almost a fifth of its value this year, opportunities for upside haven’t disappeared.

Energy producers surged 29 per cent in the first half as inflation heated up. More recently, Apple Inc. and tech companies have rebounded.

“There is greater value in single stock selection, or indeed sector selection, compared to investing passively via index trackers,” said Peter Chatwell, head of global macro strategies trading at Mizuho International Plc. “Choice of investment product matters a lot more than it did in the post-pandemic stimulus-fueled rally. The quality of analysis matters a lot more than it did in a bull market.”