Nov 21, 2019

Charles Schwab Takes Charge in Brave New Zero-Fee World

, Bloomberg News

(Bloomberg Opinion) -- You have to hand it to Charles Schwab Corp. As the market leader in the online brokerage industry, the company seems to have realized the inevitable endgame of zero fees and consolidation and decided that it really ought to get on with it.

Schwab, just seven weeks after rocking Wall Street by announcing plans to eliminate commissions for U.S. stocks, exchange-traded funds and options, is now set to buy rival TD Ameritrade Holding Corp. for $26 billion, according to reports Thursday. The combined company would have an impressive $5 trillion of assets and be better equipped to step forward into this new, no-fee world than competitors such as E*Trade Financial Corp. and Interactive Brokers Group Inc.

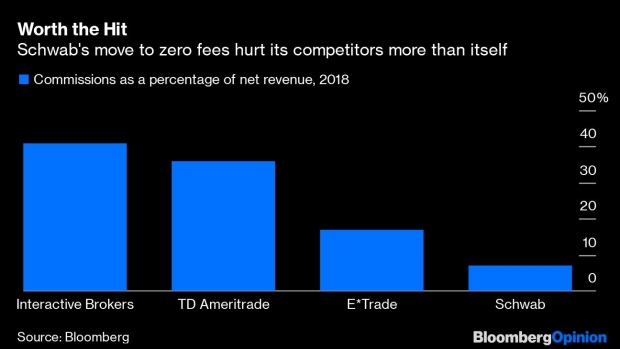

The concept of a first-mover advantage usually applies to marketing, but it’s a relevant way to think about Schwab’s strategy, too. By staying ahead of the competition, Schwab is reshaping the discount brokerage space on its terms rather than waiting to react to any changes. Bloomberg News’s Annie Massa smartly broke down the various brokerage companies’ commissions as a percentage of net revenue in 2018, which makes it obvious why Schwab chose to take the plunge toward zero fees:

It stands to reason that Schwab’s calculus went something like this:

- Yes, our stock price will take a big hit when we announce that we’re eliminating commissions (it did, dropping to the lowest since 2016 last month).

- But the short-term pain will be worth it because our rivals will have no choice but to follow suit (as they did within days).

- Because they depend on fees much more than we do, investors should sell our competitors’ shares to a greater extent (this happened, too).

- That will put us in a position to more cheaply execute the next phase of our plan, which is to grow. (It’s possible Schwab already had this deal in mind after TD Ameritrade announced in July that Chief Executive Officer Tim Hockey would leave by the end of February 2020.)

Investors expressed approval of Schwab’s decision, lifting its shares as much as 13.9% on Thursday to the highest in more than a year. It’s not as if purchasing TD Ameritrade will solve all that ails the company and the online brokerage industry. But, like the consolidation in the mutual-fund space, it ensures survival. And in an era of rapid technological change on Wall Street, living to see another day and having the size and scope to keep pace with advancements is critically important.

What’s next for Schwab? My Bloomberg Opinion colleague Nir Kaissar posited last month that the only option seems to be a more urgent push into financial advisory services. That will most likely be more of a grind for the company compared with the big splashes of the past two months. Schwab is competing with other market stalwarts like Fidelity Investments and Vanguard Group Inc., which are more difficult to push around than its discount broker rivals.

Still, even if this is the last big move for now from Schwab, it has been a whirlwind couple of months. In two sweeping moves, the company has radically reshaped an industry and positioned itself to remain the market leader for the foreseeable future.

To contact the author of this story: Brian Chappatta at bchappatta1@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.

©2019 Bloomberg L.P.