Aug 13, 2021

Charting the Global Economy: Recovery Is Progressing, Yet Bumpy

, Bloomberg News

(Bloomberg) -- The global economy is making progress returning to its pre-pandemic growth trajectory, though supply challenges and quicker inflation continue to make for a bumpy recovery.

In the U.S., rising prices are weighing on sentiment and risk restraining the pace of consumer spending growth. China’s economy is already showing a hit from the surging delta variant of Covid-19 as consumers stay at home and airplanes idle on the tarmac.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

Even as risks loom from the delta variant of the coronavirus, early signs from the third quarter show global growth accelerating and inflation peaking after its recent jump, a reassuring sign for policy makers and investors worried about the risks of faltering demand and surging prices.

U.S.

Supply constraints restraining the U.S. recovery show few signs of dissipating any time soon, weighing on growth and stoking inflation. Forecasters lowered economic growth projections for this year and lifted inflation expectations into 2022, according to Bloomberg’s latest monthly survey of economists.

Consumer sentiment fell in early August to the lowest level in nearly a decade as Americans grew more concerned about the economy’s prospects, inflation and the recent surge in coronavirus cases. The slump in confidence risks a more pronounced slowing in economic growth in coming months should consumers rein in spending.

Europe

Britain’s foreign-born population has doubled to 9 million people in the last decade, stirring a debate about immigration and social cohesion, a research group’s analysis shows.

The U.K. economy grew more than expected in June as lighter coronavirus restrictions led to renewed strength in nation’s dominant services.

Investor confidence in Germany’s recovery dropped to the lowest level since late last year after a rise in infection rates stoked concerns over a possible tightening of pandemic curbs.

Asia

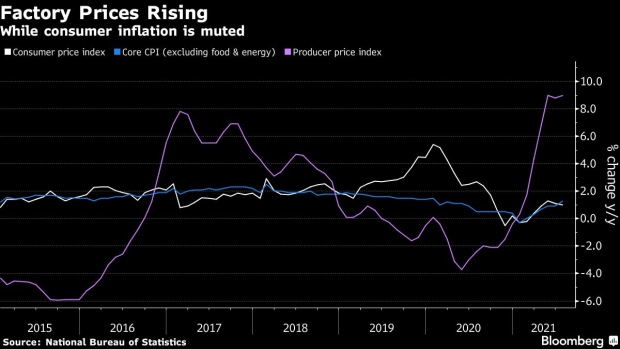

China’s economic risks are building in the second half of the year, with growth set to slow while inflation pressures are picking up, clouding the outlook for central bank support. A report Monday showed factory-gate inflation surging again to 9% in July as commodity prices climbed, while core consumer prices -- which strip out volatile food and fuel costs -- rose the most in 18 months.

Taiwan’s exporters are on a tear, with strong demand for electronics and rising prices boosting shipments. Exports already hit a record in 2020, and they’re on track to exceed that well before the end of 2021.

Emerging Markets

Central banks in Latin America continued to raise borrowing costs this week to fight inflation, with Mexico raising interest rates for a second consecutive meeting and Peru and Uruguay also hiking.

©2021 Bloomberg L.P.