Aug 27, 2021

Charting the Global Economy: Shortages, Virus Thwarting Growth

, Bloomberg News

(Bloomberg) -- Supply squeezes, labor shortages and a still-spreading coronavirus continue to complicate recoveries in many economies.

A survey of U.S. purchasing managers showed a slower rate of expansion at manufacturers and service providers, while business confidence sagged in Germany. Supply chain challenges also help explain record-low inventories in the U.K.

Virus outbreaks and government restrictions are restraining the rebound in China and Malaysia.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

U.S.

Personal spending growth moderated in July, reflecting a slowdown in outlays for merchandise, while a closely watched measure of inflation remained elevated.

Business activity continues to downshift, with growth slowing to an eight-month low in August against a backdrop of materials shortages, a lack of labor and an upswing in coronavirus infections, IHS Markit data show.

Europe

Germany’s economic recovery is coming under threat from a persistent global supply squeeze and rising Covid-19 infection numbers. A key measure of business confidence in Europe’s largest economy by the Munich-based Ifo institute slipped to 99.4 in August from 100.7 in July. The drop was bigger than economists projected.

U.K. companies grappled with record low levels of stock in August and retail selling prices rose at the fastest pace since November 2017 as increased demand strained employers’ staffing.

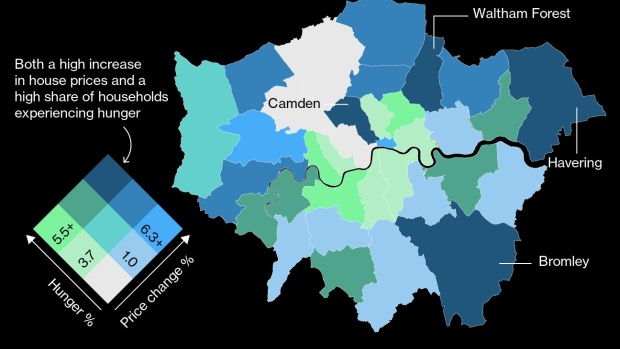

The pandemic has pulled the fortunes of British consumers in two different directions, with those who are growing wealthy on properties increasingly living near people who can barely get enough to eat.

Asia

China’s economic rebound leveled off in August, suggesting the growth momentum is faltering in the wake of the recent regulatory crackdown, the authorities’ tough response to virus outbreaks, and weak demand at home.

Malaysia leads growth downgrades by economists across Southeast Asia as the delta variant forces countries to reimpose pandemic restrictions.

Emerging Markets

Afghanistan is sitting on mineral deposits estimated to be worth $1 trillion or more, including what may be the world’s largest lithium reserves -- if anyone can get them out of the ground. If things go right, China just might try.

India’s economy held steady in July as waning Covid-19 cases paved the way for a gradual improvement in manufacturing and services activity.

World

South Korea became the first major Asian economy to raise interest rates, with more hikes in the pipeline as its central bank indicated that financial risks pose a bigger threat to the economy than the latest virus outbreak. Paraguay, Hungary and Iceland also increased borrowing costs this week.

©2021 Bloomberg L.P.