Jul 23, 2021

‘Chicken King’ Says U.K. Supply Chain at Crisis Point

, Bloomberg News

(Bloomberg) -- U.K. supermarket shelves will be bare and panic buying will intensify unless problems threatening food supplies are solved promptly, according to Ranjit Singh Boparan, founder of the eponymous British food producer and restaurant owner.

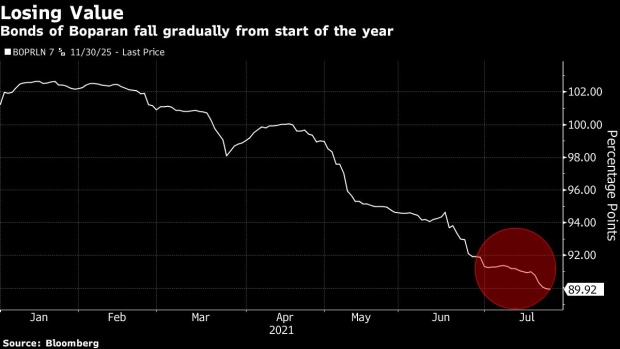

Boparan Holdings Ltd. bonds have come under pressure in recent months as investors weigh the longer term consequences of supply chain disruptions following Brexit. They’re trading at less than 90% of face value, potentially increasing future borrowing costs in the debt markets.

Companies across U.K. food and leisure sectors are sounding the alarm after a spike in coronavirus cases forced employees to self isolate to comply with government track-and-trace rules. The so-called pingdemic has exacerbated already growing risks from labor shortages and logistical barriers since the country left the European Union.

“It started with the pandemic -- and in the last week or so with ‘pingdemic,’ but since May this year the operating environment has deteriorated so profoundly I can see no other outcome than major food shortages in the U.K.” Boparan, nicknamed the “Chicken King,” said in a statement on Friday.

Bonds issued by Boparan, which produces about a third of the poultry items eaten in the U.K. each day, have lost around 10% of their face value since March, according to data compiled by Bloomberg. The 475 million pound ($653 million) bond, sold to investors in November and due to mature in 2025, was bid at around 89.3 pence on the pound on Friday.

The company has in recent years pursued a business turnaround strategy, spurred by investor concerns about its debt position.

Boparan’s founder called for changes to regulations that have reduced the number of EU workers in Britain, adding that the shortage of labor has helped push the country’s supply of chicken and turkey closer to a crisis.

©2021 Bloomberg L.P.