May 30, 2023

Chilean Telco Bonds Surge as Slim’s America Movil and Malone’s Liberty Provide Funding

, Bloomberg News

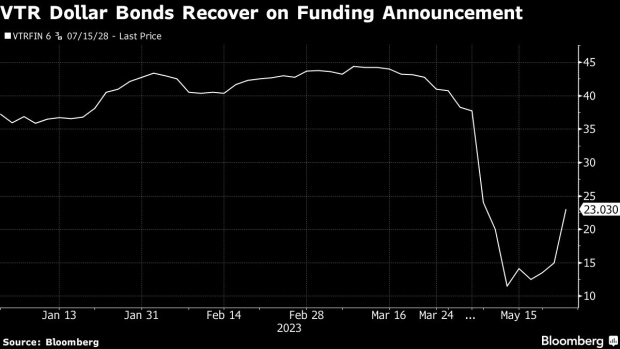

(Bloomberg) -- Bonds of distressed Chilean telecommunications company VTR Finance surged Tuesday after its shareholders, Mexico’s America Movil and Liberty Latin America, agreed to provide short term financing so it could pay its debt.

VTR’s $483 million of bonds due 2028 rose to 22 cents on the dollar from 14 cents while a separate more senior tranche also due in 2028 rose to 45 cents from 34 cents on Friday, according to pricing provided by Trace.

America Movil and Liberty agreed to provide convertible loans to ClaroVTR, a joint venture in which they own equal parts and that controls VTR Finance, according to a statement dated May 29. The joint venture has also received about $600 million so far this year, ClaroVTR said. Diario Financiero first reported the funding.

VTR’s dollar bonds had been among the worst performers among Chilean issuers after the company’s last quarterly report in which it raised “substantial doubt” that it would be able to operate as a going concern, citing fierce competition. Its net cash flow from operating activities slumped to just 5 billion pesos ($6 million) in 2022 from 135 billion pesos in 2021 as it lost clients and cut prices. Fitch, S&P and Moody’s cut the firm’s rating in recent weeks.

Read More: Billionaires Slim, Malone Sit Back as VTR Slides Toward Default

©2023 Bloomberg L.P.