Dec 7, 2019

China Clampdown on Illegal Meat Puts $2 Billion Trade at Risk

, Bloomberg News

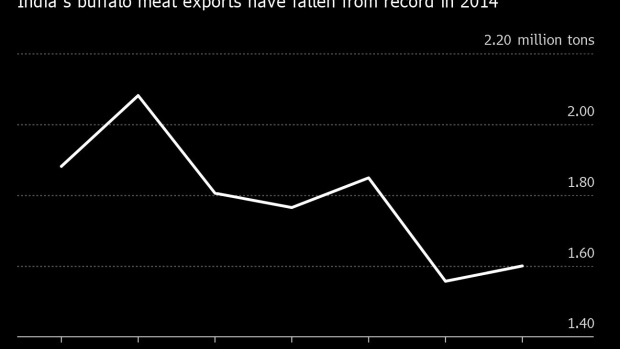

(Bloomberg) -- China’s crackdown on illegal meat imports has left India, one of the biggest exporters of buffalo meat, scrambling for a new buyer.

China has adopted stricter border controls due to African swine fever, meaning Indian buffalo meat exports into China that usually flow through Vietnam has all but stopped. Indian exporters are now hoping Indonesia can more than triple its meat imports from the South Asian nation to make up for the heavy losses this year.

Tighter border controls in China have hurt a black market meat trade that’s normally worth about $2 billion a year. India can’t directly sell buffalo meat to China due to a ban by Beijing since 2001 following an outbreak of foot-and-mouth disease.

China, the biggest consumer of pork, has boosted beef and other meat imports as consumers seek alternatives following the deadly swine disease that’s killed millions of pigs.

Indian shipments of buffalo meat and offal to China via Vietnam, Myanmar, Thailand and Hong Kong, has slumped 23% from a year earlier to 14,645 containers this year to October, according to data compiled by the All India Meat and Livestock Exporters Association. Government figures showed exports to Vietnam, India’s biggest buyer, dropped 34% to 202,873 tons in the six months ended in September.

Focus on Indonesia

Exporters want to boost sales to Indonesia to 300,000 tons a year from 80,000 tons now, said Fauzan Alavi, vice president of the association. The group has been pushing for the government to talk to Indonesia to get the import quota increased, he said, adding that the association was expecting a positive outcome soon. India has also requested that China lift its ban on imports, Alavi said.

The association has also been pressing the Indian government to cut export taxes on raw hides to remain competitive in the global market.

The processors are struggling to sell raw hides despite a reduction in India’s export duty to 40% in July from 60%, Alavi said. Australia, the U.S. and Canada have zero export duties, while there’s just a 9% tax in Brazil, he said.

The duty removal is crucial for the survival of the industry at a time when most tanneries are shut and some are working at lower capacities, said Alavi, who’s also a director with Allanasons Pvt., India’s biggest buffalo meat exporter.

“Even if China takes time to allow imports from India, higher sales to Indonesia and a cut in raw hide duties will keep us afloat,” Alavi said in an interview.

To contact the reporter on this story: Pratik Parija in New Delhi at pparija@bloomberg.net

To contact the editors responsible for this story: Anna Kitanaka at akitanaka@bloomberg.net, Atul Prakash

©2019 Bloomberg L.P.