Feb 24, 2022

China Crackdown Leaves Bond Investors With Few Places to Hide

, Bloomberg News

(Bloomberg) -- Losses in Chinese debt markets are spreading beyond the battered real estate sector, sending the nation’s investment-grade bonds to a 21-month low as creditors grow increasingly wary of blue-chip borrowers including Alibaba Group Holding Ltd.

Renewed concerns about the Chinese government’s crackdown on tech companies are compounding worries about everything from rising U.S. rates to the Russia-Ukraine conflict and weak consumer spending.

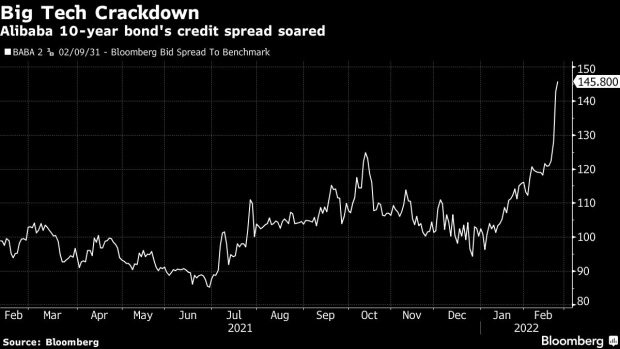

The tumble in Alibaba’s bonds sent the yield spread on its 10-year dollar note to a record high on Thursday. Meituan and Tencent Holdings Ltd. bonds have also slumped in recent days, while a Bloomberg index of Chinese investment-grade debt dropped to the lowest level since June 2020. Hotpot chain Haidilao International Holding Ltd. and Macau casino operator SJM Holdings Ltd. have paced declines among consumer companies.

The selloff is burning investors who thought higher-rated bonds would provide a haven from the liquidity crisis that triggered record defaults by developers including China Evergrande Group. While some say the slump is creating buying opportunities, Russia’s invasion of Ukraine on Thursday has injected a fresh dose of risk into an already jittery market.

“In light of the intensifying Russia-Ukraine conflict, there are sellers for off-the-run names, new issues, and high-beta names,” said Wu Qiong, executive director at BOC International.

Even some state-owned companies are coming under pressure. Bad-debt managers including China Huarong Asset Management Co. have been among the market’s most notable losers in recent weeks on concern they’ll be called upon to shore up the property market and ailing banks. An offshore subsidiary of Citic Group, which became one of the largest shareholders of Huarong after a state-led bailout in November, recently priced a 10-year dollar bond at 175 basis points over Treasuries, 43 basis points higher than an issue of the same tenor two years earlier.

For consumer companies, the fear is that increasingly frequent Covid outbreaks in China will dampen spending and raise the risk of financial distress.

Earlier this week, S&P Global Ratings put Haidilao, which has a BBB credit rating, on negative watch, citing the restaurant chain’s latest profit warning. The company is expected to incur over 3 billion yuan ($474 million) of losses from the closure of more than 300 restaurants last year. Fitch downgraded SJM Holdings on Monday, citing China’s travel restrictions and uncertainty over a new gaming law in the former Portuguese colony.

Chinese issuers have little direct exposure to Russia or Ukraine, according to Michael Taylor, managing director at Moody’s Investors Service. But that hasn’t stopped investors from reducing exposure in response to the prospect of a destabilizing war. The market “felt pretty stable until Russian-Ukraine headlines hit the wires,” Standard Chartered Plc’s credit desk wrote in a note to clients on Thursday. “We never looked back thereafter.”

©2022 Bloomberg L.P.