Mar 8, 2023

China Defaulter Jinke’s Global Creditors Turn Onshore for Help

, Bloomberg News

(Bloomberg) -- Investors in a Chinese developer’s defaulted dollar bond are seeking help from mainland authorities, as an unprecedented property debt crisis prompts creditors to try various ways to get their money back.

The legal adviser of an ad-hoc group of holders of Jinke Properties Group Co.’s sole US-currency bond sent a letter dated March 2 to officials “to supervise repayment of offshore notes” after failing to gain any response from the company, according to a copy of the letter seen by Bloomberg News. The letter was addressed to the Shenzhen Stock Exchange, where Jinke is listed, and the financial authority and the securities regulator’s local branch in the southwestern city of Chongqing.

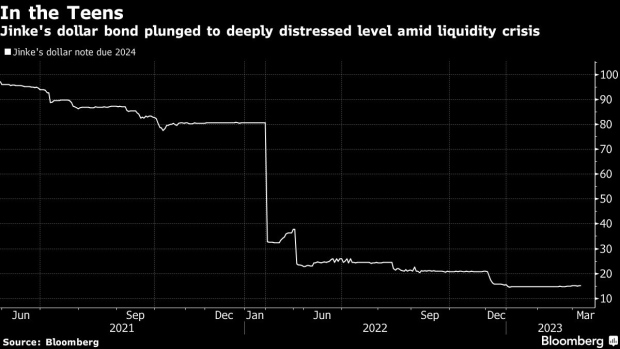

The Chongqing-based developer, China’s 29th-largest by sales, defaulted after missing an extended and final deadline for coupon payment on its 6.85% $325 million note in late December, according to the letter.

Jinke’s investor relations department didn’t immediately respond to calls and an email seeking comment. The Shenzhen exchange and the securities regulator’s Chongqing branch didn’t immediately reply to emails requesting comment. The city’s financial supervision bureau couldn’t be reached for comment.

The action taken by Jinke’s dollar bond investors is a reminder of the challenges faced by global creditors given insufficient protection from China’s legal system and a strong inclination by defaulters to prioritize local investors’ demands. The developer’s case is also unique as it doesn’t have any stock listing or unit associated with the dollar bond outside mainland China, which further limits the offshore creditors’ options.

While Chinese stock exchanges are entitled to request an explanation from listed firms on matters including financial dispute, it’s unclear what sort of help the country’s securities regulator and local authorities may be able to offer to offshore creditors like Jinke’s.

Jinke hasn’t communicated with the ad hoc group, who represents not less than 50% of the bond’s principal outstanding, since the failure to pay, the letter says. Nor has it responded to two letters and a payment request notice sent by the group to the company in early February.

The creditor group also said in the letter that if Jinke fails to repay or provide a restructuring plan by the end of this month, it will take legal steps in China, including initiating court-led restructuring proceedings against the firm. If such action materializes, it would set the precedent for holders of publicly traded offshore Chinese bonds to bring their legal battle to an onshore court.

The apparent grievances felt by Jinke’s offshore creditors are in stark contrast to the way the developer is handling investors in its local bonds. The builder, which also defaulted on a yuan note in late October, has presented bondholders a preliminary restructuring plan that includes maturity extensions for various notes.

As more Chinese developers became distressed amid an industry-wide cash crunch, there’s been a growing trend among them to leave offshore creditors out in the cold and focus on addressing the concerns of local investors, many of whom hold the key to the companies’ long-term survival.

This has forced global creditors to resort to tools from filing court petitions in Hong Kong to dissolve Chinese defaulters’ offshore entities to unconventional tactics like publishing angry protest letters in newspapers.

©2023 Bloomberg L.P.