Oct 3, 2018

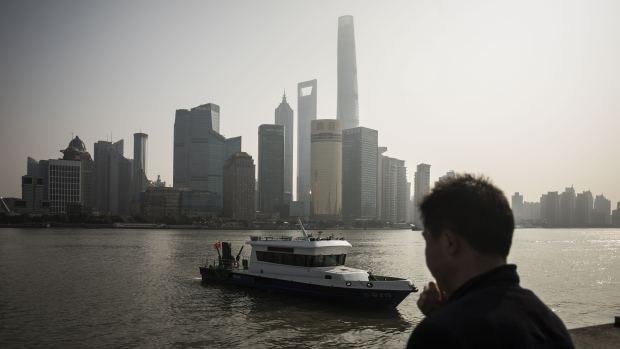

China ETF sinks as JPMorgan sees 'full-blown trade war'

, Bloomberg News

The biggest exchange-traded fund tracking Chinese equities tumbled Wednesday after JPMorgan Chase & Co. downgraded the nation’s stocks, forecasting a "full-blown trade war" next year.

The conflict between the world’s two largest economies will only escalate as the U.S. maxes out tariffs on Chinese imports, the dollar strengthens and the yuan weakens further, JPMorgan strategists including Pedro Martins Junior, Rajiv Batra and Sanaya Tavaria wrote in a report, lowering their recommendation on the shares to neutral from overweight. The US$4.9 billion iShares China Large-Cap ETF sank to a two-week low.

"A full-blown trade war becomes our new base case scenario for 2019," the strategists wrote. "There is no clear sign of mitigating confrontation between China and the U.S. in the near term."

Tensions between Washington and Beijing flared up again last week when the Trump administration slapped a 10 per cent tariff on about US$200 billion of Chinese goods. Xi’s government responded in kind with duties on US$60 billion in U.S. products, scuppering hopes for any quick solution to the dispute.

Still, that may not impede a relief rally in emerging markets, according to JPMorgan. The New York-based bank said double-digit earnings growth, an under-allocation to the asset class and a valuation discount to developed-market equities could spur near-term gains.

JPMorgan revised its forecast for economic growth in China next year to 6.1 per cent from 6.2 per cent. Without accounting for countermeasures, the trade war represents a 1 percentage point dent to growth, the strategists said.

"Higher tariffs are squeezing Chinese manufacturing’s profit margin, reducing the investment incentive and hiring, which would then drag on consumption via reduced income," they wrote.