Jun 6, 2023

China Exports Drop More Than Expected, Adding to Economic Risks

, Bloomberg News

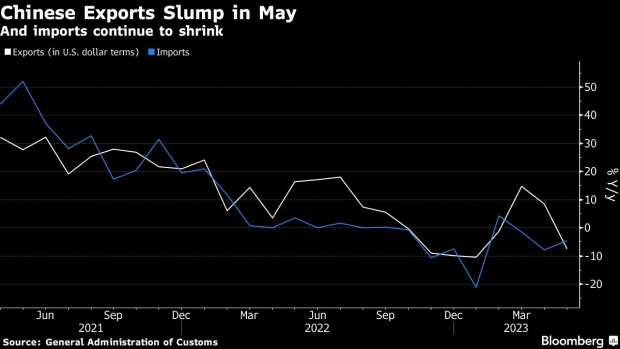

(Bloomberg) -- Chinese exports fell for the first time in three months in May, adding to risks in the world’s second-largest economy as global demand weakens.

Overseas shipments shrank 7.5% from a year ago to $284 billion, official data showed Wednesday, worse than the median forecast for a 1.8% drop. Exports to most destinations contracted, with double-digit declines to places including the US, Japan, Southeast Asia, France and Italy.

Imports declined 4.5% to $218 billion, better than an expected drop of 8%, leaving a trade surplus of $66 billion. Chinese purchases from most regions declined in May, with contractions of more than 20% in imports from Taiwan and South Korea — a sign of weakness in global electronics demand.

The expansion in exports earlier this year was one bright spot for the economy, helping to underpin the recovery after China dropped its pandemic rules. However, recent data shows the recovery has weakened, with manufacturing activity contracting in May and home sales growth slowing after a pickup earlier in the year.

The trade report is “yet another disappointing data which will raise growth concerns and intensify expectations of more policy support,” said Khoon Goh, a strategist at Australia & New Zealand Banking Group.

What Bloomberg Economics Says...

China’s falling exports and imports in May offer more evidence that weak demand — both from abroad and at home — is crippling the recovery. With the statistical quirk that boosted April’s figures out of the way, these numbers give us a clearer picture of a reality that is challenging. Bottom line: the data reinforce our view that more policy support is needed, including a rate cut which we think will be delivered as soon as this month.

For the full report, click here

Eric Zhu, China economist

The drop in exports shows how a slowing global economy is starting to affect China, with Wednesday’s data showing the value of exports fell from April, the second straight month-on-month decline. Economists surveyed by Bloomberg predict China’s exports to contract for the full year.

Speculation is growing that Beijing may have to deliver more stimulus to bolster growth. Some economists expect the central bank to cut the reserve requirement ratio for banks in coming months, while others argue an interest rate cut may be necessary, possibly as early as next week.

One sustaining bright spot for Chinese exporters was the continued strength of global demand for Chinese cars, with total vehicle shipments hitting a record for any single month of $9 billion. One of the drivers of the recent surge in car exports has been the popularity overseas of Chinese electric vehicles, although shipments of other types of cars has also been rising.

Read more: China’s BYD Is Taking On the World EV Market—Except in America

The benchmark CSI 300 Index closed 0.5% lower on Wednesday, underperforming its Asian peers. The offshore yuan weakened 0.1% at 7.1367 per dollar as of 4:37 p.m. local time.

The government set a relatively conservative growth target of around 5% for the year, which most economists expect will be achieved even with the recent slump in activity. Consumer spending on travel and restaurants has so far fueled the economy’s recovery, while industrial activity has lagged.

--With assistance from Xiao Zibang.

(Updates with details on vehicle exports hitting a record.)

©2023 Bloomberg L.P.