Jul 11, 2020

China Gives World First View of Post-Lockdown Rebound: Eco Week

, Bloomberg News

(Bloomberg) -- The country first hit by the coronavirus pandemic will this week have a clearer picture of its progress on nursing the economy back to health.

China reports second-quarter gross domestic product on Thursday, along with monthly readings for industrial output and retail sales. An easing of lockdown measures plus a modest amount of policy stimulus should be enough to post a positive growth rate, after the historic 6.8% collapse in the first quarter.

Economists forecast a 2.5% expansion in the three months to June, with the recovery momentum largely unscathed even after a fresh outbreak in Beijing prompted the return of some controls on movement.

That flare-up served as a reminder that even amid a strengthening domestic economy, consumption remains weak and vulnerable to sudden downturns. As the world’s manufacturing hub, China is also still suffering from the collapse in global demand amid the pandemic.

What Bloomberg’s Economists Say:

“A clear upturn in China’s industrial production suggests the economy expanded in 2Q after cratering in 1Q due to the coronavirus impact. Even so, weakness in private and external demand means the pace of growth is likely to be well below historical levels. Activity data for June are expected to show the recovery has withstood a resurgence in Covid-19 cases in Beijing.”

--Chang Shu and David Qu, Bloomberg Economics. For full preview, click here

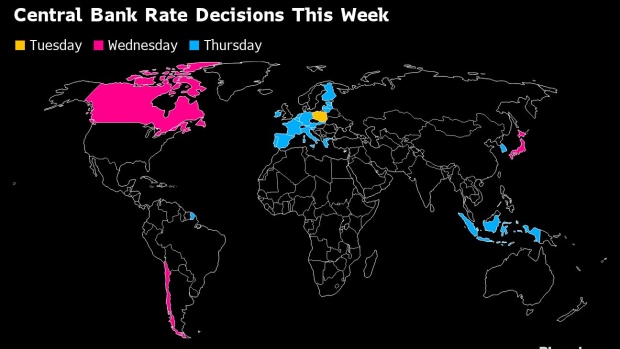

Elsewhere, it’s a busy week for central banks, with policy makers in Japan, South Korea, Indonesia, Canada, Chile, Poland and the euro area among those setting policy.

Click here for what happened last week and below is our wrap of what else is coming up in the world economy.

U.S. and Canada

In the U.S., the economic calendar gets busier with retail sales and jobless claim data taking center stage. Retail sales continued to bounce back in June, with forecasts calling for a smaller-yet-still-robust advance -- after a record surge a month earlier as state economies reopened from lockdowns.

Other reports are projected to show firmer new-home construction and industrial output in June, while consumer sentiment improved slightly in early July. At the same time, a recent rise in coronavirus cases calls into question the strength of the economic rebound in coming months.

It’s also the last week that Federal Reserve officials will make the rounds before a blackout on their public speeches begins Friday at midnight ahead of the July 28-29 meeting. Regional Fed presidents including John Williams, Robert Kaplan, Charles Evans, Pat Harker and Jim Bullard are set to speak. The Fed’s Beige Book is released on Wednesday.

In Canada, the central bank will announce its next steps in policy on Wednesday as it transitions from emergency financing toward keeping the expansion alive.

- For more, read Bloomberg Economics’ full Week Ahead for the U.S.

Europe, Middle East and Africa

With the European Central Bank expected to keep policy unchanged when it meets on Thursday, investors will be looking for any signs whether officials think more stimulus measures may be needed down the line to aid the euro area’s fragile recovery. Poland’s central bank will also meet on interest rates, with no changes anticipated.

Sweden’s Riksbank will publish minutes of its June 30 meeting, in which officials ramped up stimulus and pledged to buy corporate bonds. Ukrainian President Volodymyr Zelenskiy is expected to nominate a candidate to replace central bank Governor Yakiv Smoliy after his shock resignation.

On the data front, investors will be watching for new figures on the U.K. economy for May after the biggest drop on record in April, with June figures for inflation and jobless claims also due. Norway will announce estimates for economic output in May, amid forecasts of a 5% contraction this year. Inflation numbers are scheduled for Israel, South Africa and Nigeria, while Russia and Turkey are set to get the latest readings for industrial production.

For more, read Bloomberg Economics’ full Week Ahead for EMEA

Asia

Both the Bank of Japan and the Bank of Korea are expected to stand pat as they assess the effectiveness of the virus-response measures they have rolled out so far. Indonesia is set to cut rates again on Thursday, according to early expectations from economists.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Latin America

On Tuesday, Brazil’s economic activity report for May could surprise after sales and output improved over April’s historic declines. While Brazil’s patchwork coronavirus response helped to underpin its economy, an uncompromising national lockdown throttled Peru’s: June’s economic activity index posted Wednesday may only show limited improvement over May’s 40% drop.

In a similar vein, Colombia’s retail sales data for May will likely rival April’s record 43% fall.

Chile’s central bank will all but certainly keep its key rate at a record low 0.5% while possibly expanding bond buybacks.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

©2020 Bloomberg L.P.