Dec 1, 2022

China Has Vast Room for Property Demand, Government Adviser Says

, Bloomberg News

(Bloomberg) -- Chinese households still have enormous demand for real estate and the industry remains a key driver of economic growth, according to a senior researcher with the nation’s top economic-planning agency.

“Chinese residents still have rather high rigid demand for housing as their income continues to improve,” said Wang Changlin, head of the China Academy of Macroeconomics, a research institute of the National Development and Reform Commission. “There is still rather vast room for demand in the real estate market.”

The real estate sector makes “relatively big contributions” to investment, consumption and services, and is a “significant driver” of activity in upstream and downstream industries, Wang said in a response to faxed questions to the NDRC. The Politburo has stressed this year the need to promote the steady and healthy development of the industry, showing China’s leadership is “paying high attention” to property, he added.

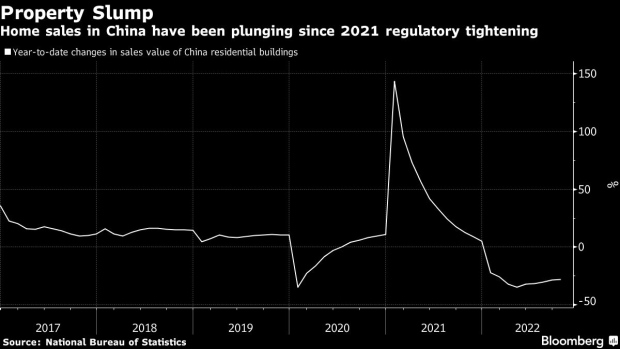

Wang’s comments add to signs Beijing has shifted its stance toward supporting the property market amid the sector’s worst downturn on record. In the past few weeks alone, regulators have rolled out a package of 16 measures to ease the liquidity crunch for developers, pushed banks to boost lending to the companies, and loosened down-payment curbs for homebuyers.

While trying to improve a long-term mechanism to ensure the sustainable development of the property market, China is also accelerating efforts to foster new growth engines, Wang said. Some of the focus areas are the digital economy and strategic emerging industries, he said.

The latter refers to sectors such as new-generation information technology, biotech, renewable energy, and new materials, according to China’s 14th five-year economic plan.

President Xi Jinping’s goal, outlined in his speech to the 20th Communist Party congress in October, is for China to achieve “new breakthroughs” in “high-quality development” in the coming five years.

High-quality development means economic growth will be maintained at a reasonable range, income distribution will be more balanced, and industrial and supply chain resilience and security will improve, Wang said. It also implies Chinese firms will be more competitive, bigger in size, and more influential in brand power, and gain greater say in making industrial standards and regulation, he added.

©2022 Bloomberg L.P.