Sep 27, 2022

China High-Grade Dollar Bonds Offer a Relative Haven Amid Rout

, Bloomberg News

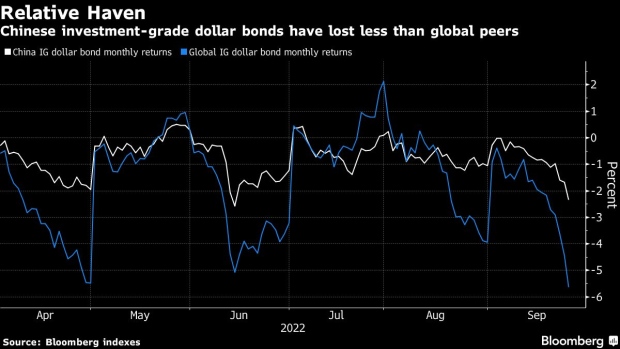

(Bloomberg) -- Investment-grade dollar bonds from Chinese issuers have been a relative bright spot during the ongoing global rout, and some credit investors expect continued outperformance.

The nation’s high-grade notes have lost 2.3% this month, versus a 5.6% decline for dollar bonds in a global benchmark, according to Bloomberg indexes.

The Chinese securities weakened further Tuesday, according to credit traders. They had their biggest loss since early August on Monday, but global peers fell the most in three months while dropping for an eighth session, their longest losing streak since 2016.

“China is still considerably better off than some other Asia economies, and that gives us confidence in the safer credit there,” according to Gordon Tsui, head of fixed income at Ping An of China Asset Management (Hong Kong) Co. The firm continues to favor short-dated dollar debt of Chinese state-owned entities or firms backed by the central government, with Tsui saying they could offer some stability.

Many asset classes have been sliding of late in the wake of hawkish central banks and recession fears, with US Treasury yields at their highest in more than a decade. But the People’s Bank of China has been easing policy to support a slowing economy pressured by Covid-19 lockdowns and the property sector’s woes. So far this year, Chinese high-yield dollar bonds have lost 12%, compared with 20% for the global index.

Rick Wen, senior portfolio manager at ICBC Asset Management Global Co., said investment-grade SOE bonds are attractive because of their widening yields relative to onshore debt, some of which are at record lows. One of the key strategies the rest of this year is currency hedging, he added.

The growing gap between onshore and offshore notes has helped accelerate Chinese investors’ purchases of offshore debt in recent months, as yields have surged outside the country and the yuan has fallen toward the lowest level since 2008 versus the greenback. But it’s retained its value versus many other currencies.

Despite the recent performance of Chinese high-grade dollar notes, “there is almost no safe haven in this selloff,” said Tsui. “We’ve already entered a ‘crisis mode’ after the gilt selloff, with many Asia credits increasingly under selling pressure. Overall it’s preferable to maintain a high cash level and stay defensive.”

(Adds details and comment in the sixth and seventh paragraphs.)

©2022 Bloomberg L.P.