(Bloomberg) -- China’s government is assembling a group of accounting and legal experts to examine the finances of China Evergrande Group, a potential precursor to a restructuring of the world’s most indebted developer.

Regulators in Evergrande’s home province of Guangdong dispatched a team last month from King & Wood Mallesons, a law firm whose specialties include restructuring, two people familiar with the matter said, asking not to be identified discussing private information. At the urging of Beijing, provincial officials are also sending additional financial advisers and accountants to assess the developer, one of the people said.

The task force is the latest sign that Chinese authorities are laying the groundwork for what could be one of the country’s biggest debt restructurings. While senior leaders in Beijing have yet to indicate whether they would allow Evergrande creditors to suffer major losses, bondholders are pricing in slim odds of a rescue. Guangdong officials have turned down at least one bailout request from Evergrande’s billionaire founder Hui Ka Yan, who owns a controlling state in the developer, one person familiar with the matter said.

Pressure is building on Hui and Chinese authorities to find a resolution to Evergrande’s crisis. The developer is falling behind on commitments to suppliers, retail investors and homebuyers, raising the specter of social unrest after a spate of protests at Evergrande offices across China.

Guangdong’s government has encouraged Evergrande’s major banks to set up a creditor committee, a move that would allow lenders to take over major decisions including asset disposals, two people familiar with the matter said. The banks are reluctant to do so before getting a clear nod from national regulators, the people said.

China’s Financial Stability and Development Committee, the nation’s top financial regulator, gave its blessing to an Evergrande plan last month to renegotiate payment deadlines with banks and other creditors on a piecemeal basis, a person familiar with the matter told Bloomberg last week. It’s unclear whether recent developments, such as the investor protests, have caused Beijing to reconsider.

Evergrande said on Tuesday it has hired restructuring specialists Houlihan Lokey and Admiralty Harbour Capital as joint financial advisers to explore “all feasible solutions” to ease its cash crunch, saying there’s no guarantee it will meet its financial obligations.

The developer said property sales will drop in the normally buoyant month of September because of waning confidence among homebuyers, adding that it had made “no material progress” on plans to sell stakes in its electric-car and property services units. Asset sales had been one of the most important pillars of Evergrande’s plan to escape its cash crunch.

King & Wood, the law firm tapped by Guangdong province, is one of China’s biggest providers of insolvency restructuring services. It has been involved in high-profile cases including HNA Group, Brilliance Auto Group Holdings Co. and China Fortune Land Development Co.

Evergrande, Guangdong’s government and King & Wood didn’t immediately respond to requests for comment.

In a statement late Monday, Evergrande said rumors that it will go bankrupt are untrue. While the company acknowledged “unprecedented” difficulties, it said it was doing everything possible to restore normal operations and protect the rights and interests of customers.

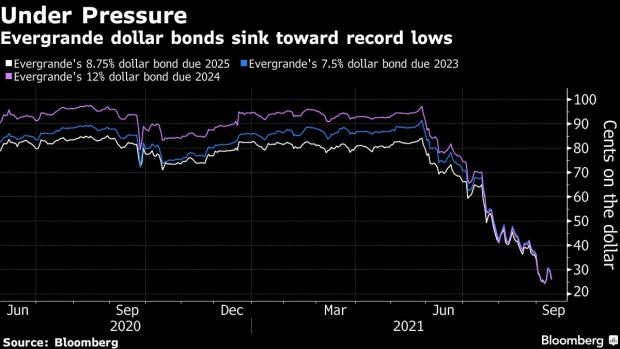

Evergrande shares fell as much as 12% in Hong Kong on Tuesday to the lowest since December 2014. The stock has lost about 80% this year. Evergrande’s 8.25% dollar bond due 2022 dropped about 6 cents to 26 cents on Tuesday, according to Bloomberg-compiled prices.

With more than $300 billion in liabilities, Evergrande has become the biggest test yet of President Xi Jinping’s willingness to let overindebted companies fail as he tries to wring the excesses out of China’s $54 trillion financial system.

On top of its obligations to domestic investors and overseas bondholders, Evergrande owes about $147 billion in trade and other payables to suppliers and received down payments on yet-to-be-completed properties from more than 1.5 million home buyers as of December.

©2021 Bloomberg L.P.