Sep 14, 2022

China Holds Key Rate, Withdraws Liquidity Amid Yuan Defense

, Bloomberg News

(Bloomberg) -- China’s central bank drained liquidity from the banking system for a second straight month while leaving rates unchanged as it sought to ease pressure on the yuan from a widening policy divergence with the Federal Reserve.

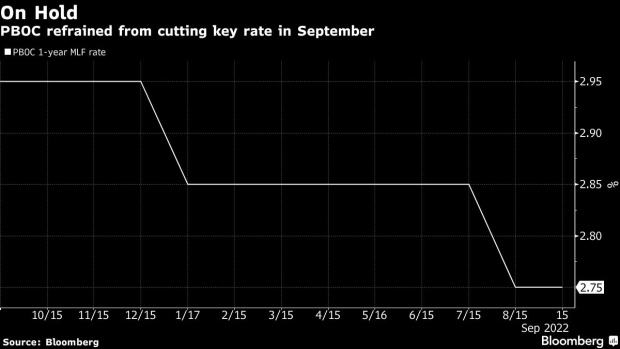

The People’s Bank of China offered 400 billion yuan ($58 billion) via its medium-term lending facility, matching the median forecast in a Bloomberg survey. That would result in a net withdrawal of 200 billion yuan in September. The rate was held at 2.75% after being lowered by 10 basis points in August.

PBOC caution on easing comes amid heightened concerns over capital outflows after US inflation data renewed bets for a large Fed hike this month. It also follows data that showed a slow recovery in China’s credit growth last month, which may have reduced the urgency for back-to-back rate cut while the impact of other measures to support the economy take effect.

“It would be quite rare for the PBOC to cut rates consecutively except in a crisis mode,” said Xiaojia Zhi, economist at Credit Agricole CIB in Hong Kong. “Looking ahead, we think the PBOC could be hesitant to adjust the MLF rate lower in the near term, given expectations for rapid tightening by the Fed and the depreciation pressure on the yuan.”

Jitters over a diverging monetary policy with the US have already put the yuan on track for its worst annual loss since 1994. The PBOC set a string of stronger-than-expected yuan fixings and reduced banks’ foreign-currency reserve requirement to support the currency. The yuan still remains within striking distance of a two-year low touched last week.

Tighter liquidity could reduce the downward pressure on the yuan. It may also somewhat ease concerns that the excess cash in the banking system would increase financial risks by fueling asset bubbles.

It makes sense for the PBOC to drain some excess liquidity via the MLF operation as it has relied more on the use of structural monetary policy tools, said Winson Phoon, head of fixed income research at Maybank Securities Pte Ltd. in Singapore. The central bank will provide more than 200 billion yuan in special relending funds, the State Council announced after a meeting Tuesday.

PBOC officials have signaled they have enough monetary policy room to act to support the economy amid subdued inflation. Deputy Governor Liu Guoqiang said this month policy space is “ample” and the toolbox is sufficient, both in terms of price-based and quantity-based instruments.

Yields on China’s 10-year government bonds are little changed at 2.66% on Thursday after rising in the last two sessions. The onshore yuan fell 0.1% to 6.9704 as of 3:40 p.m. local time.

Growth Headwinds

China’s growth projections have come down steadily since March, when the official target of around 5.5% was first disclosed. The consensus in a Bloomberg survey is for the economy to expand 3.5% this year. Growth is not only pressured by lockdowns but a housing market collapse is also also weighing on the economy.

Moreover, official data for August, due to be published on Friday, will likely show little improvement in industrial output, retail sales and investment. That’s prompting some analysts to bet on further central bank easing this year.

The PBOC still has room to inject more liquidity in the fourth quarter, with the potential for a 50 basis points cut in banks’ reserve requirement ratio to accommodate local government bond issuance and to partially replace MLF funding, Credit Agricole’s Zhi said.

Analysts are now watching if banks would lower their loan prime rates next week after major state-owned banks cut deposit rates for individuals.

“It provides more policy room for banks to lower LPRs,” said Liu Peiqian, chief China economist at NatWest Group Plc, who sees a higher chance of another 5-10 basis point cut in the five-year LPR in the coming months to boost the demand for mortgage loans.

(Updates throughout.)

©2022 Bloomberg L.P.