Sep 23, 2019

China Imported More Palm Oil Than it Has in Six Years

, Bloomberg News

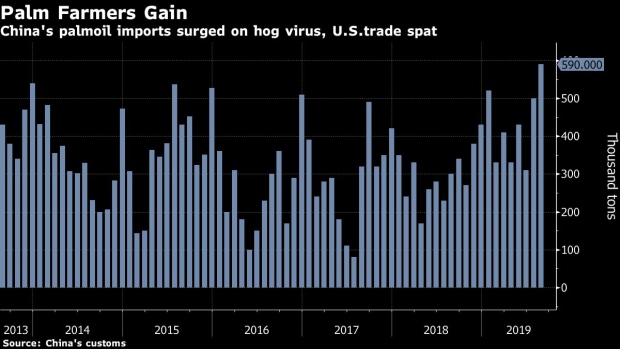

(Bloomberg) -- China imported the most palm oil in more than 6 years last month after the outbreak of African swine fever hurt domestic soybean crushing and the country cut soy imports from the U.S. as their trade conflict escalated.

- China bought 590,000 tons of palm oil in August, almost double last year’s amount and the highest monthly total since December 2012, according to customs data Monday. Imports in the first eight months of the year rose 59% to 3.42 million tons.

Key Insights

- Swine fever has slashed the country’s hog herd and lowered demand for soybean meal, used in livestock feed, so that fewer beans are crushed and less oil is produced. Reduced U.S. imports have also shrunk the quantity of beans available for processing, leaving China in need of edible oil alternatives.

- The surge in imports came ahead of peak consumption season that includes a holiday in September and the week-long National Day break in October.

- Palm oil imports are expected to stay high in September and October, with imports of more than 600,000 tons each month likely, according to the China National Grain and Oils Information Center.

- China’s palm oil imports in the year starting October may rise to a record 7 million tons, versus 6.5 million tons in the current year, according to the CNGOIC.

- Reduced soy oil output is likely to boost the country’s total edible oil imports in the current year to 10 million tons, up from 7.5 million tons in the previous year, it said.

Get More

- China’s beef imports fell in August from July’s record to 130,619 tons, but still 32% higher than a year ago. Imports of pork surged 76% on the year to 162,935 tons.

- China’s sugar imports in August rose to the highest since April 2018 after the government issued more import quotas to mills

- READ: Trade Blow for U.S. Soy Farmers Is Godsend for Palm Oil Growers

To contact Bloomberg News staff for this story: Niu Shuping in Beijing at nshuping@bloomberg.net

To contact the editors responsible for this story: Anna Kitanaka at akitanaka@bloomberg.net, Jason Rogers, Atul Prakash

©2019 Bloomberg L.P.