May 1, 2022

China lockdowns wreak havoc on economy as Xi pledges support

Bloomberg News

Chinese Technology Stocks Gain on Possible Easing of Crackdown

China’s stringent lockdowns to curb COVID-19 infections are taking a significant toll on the economy and roiling global supply chains, with President Xi Jinping under pressure to deliver on pledges to support growth.

The damage from shutdowns in April in major financial hub Shanghai, auto manufacturing center Changchun and elsewhere was laid bare by the first official data for the month released over the weekend.

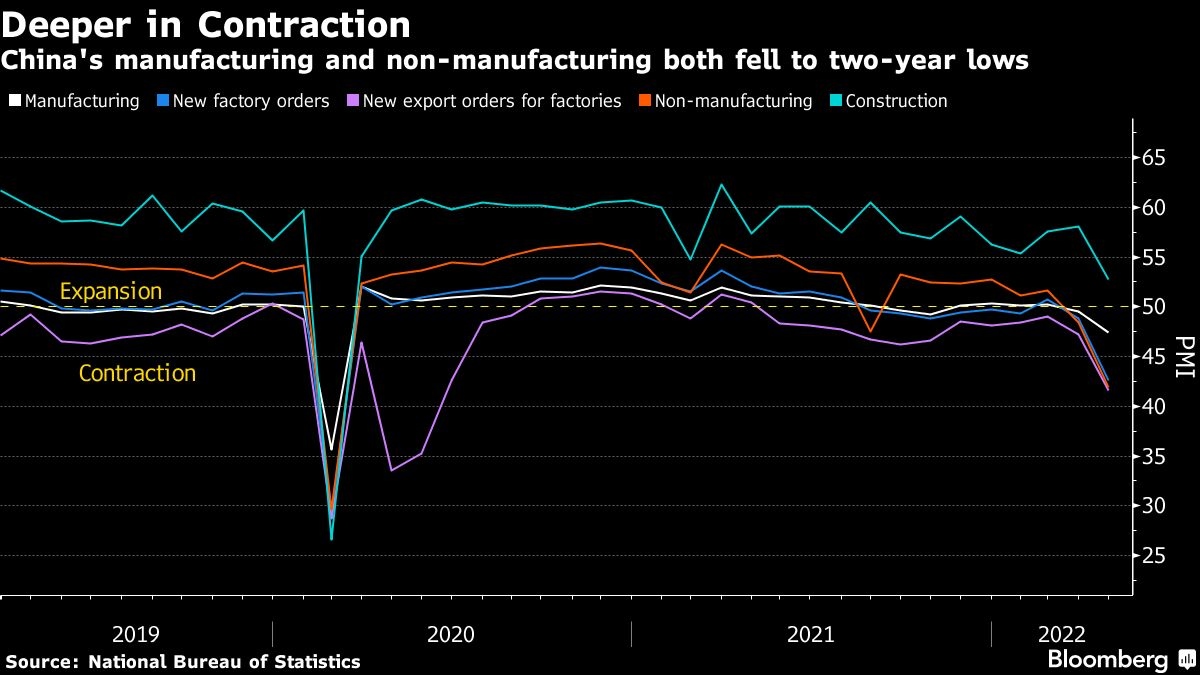

Both manufacturing and services activity plunged to their worst levels since February 2020, when the nation imposed a range of restrictions amid its initial coronavirus outbreak centered in Wuhan, according to purchasing managers surveys. The offshore yuan weakened in the wake of the data.

The strain on global supply chains is also becoming apparent, with the PMI data showing suppliers face the longest delays in more than two years in delivering raw materials to their manufacturing customers. Inventories of finished goods climbed to the highest level in more than a decade, while indexes for exports and imports slumped.

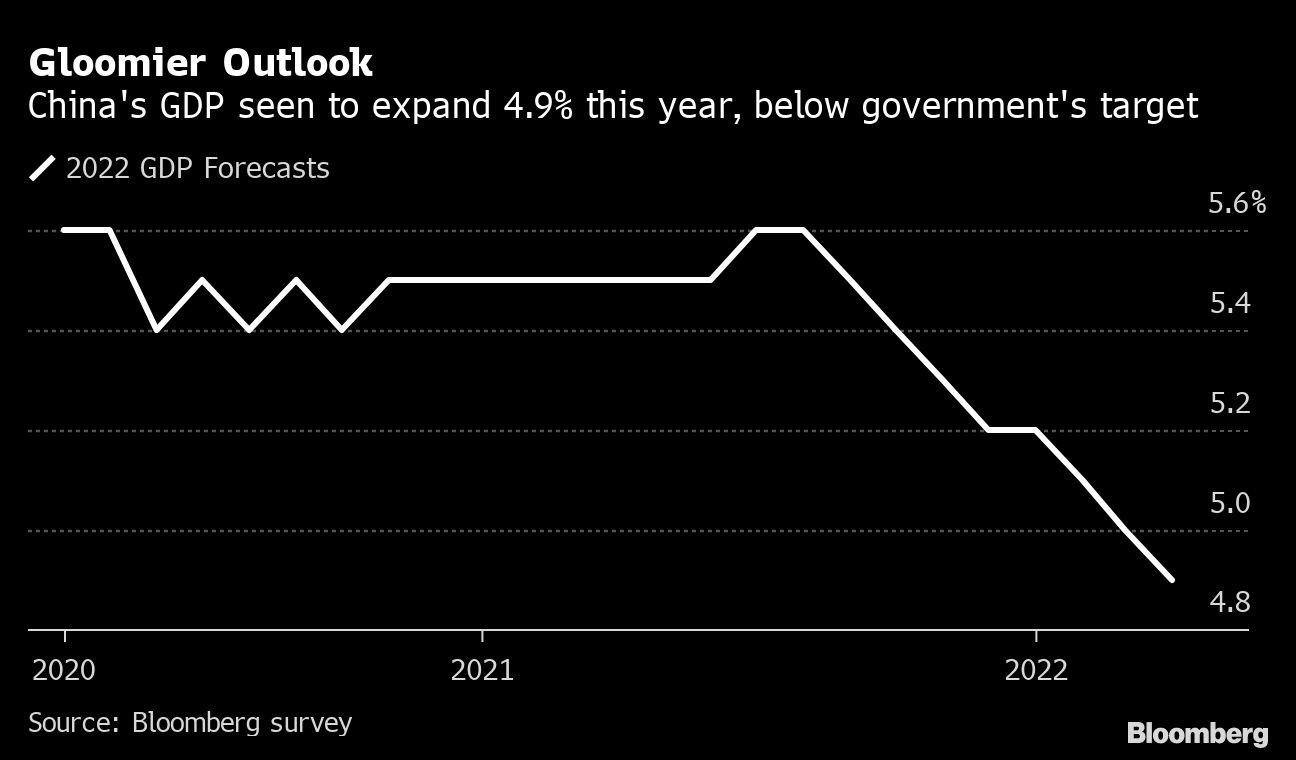

The figures came a day after the Communist Party’s Politburo, led by Xi, promised to meet its economic targets while at the same time sticking with its COVID Zero policy to curb infections. Economists see the two goals as contradictory, with many cutting their growth projections to well below the government’s official target of around 5.5 per cent.

“I expect GDP growth in the second quarter to turn negative, as lockdowns will likely be on and off,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “The key issue going forward is how the government will fine-tune its ‘zero tolerance’ policy to mitigate the economic damage.”

Nevertheless, the Politburo’s comments -- which were timed during the trading day -- fueled a rally in stocks and the currency, with technology shares surging on signs of a possible easing of a regulatory crackdown on internet platform companies. Investors were also encouraged by comments suggesting a loosening of property restrictions and a push to boost infrastructure investment.

Xi appeared to soften his stance toward the private sector, telling the Politburo meeting that the healthy development of private capital should be encouraged. At the same time, he said capital must be regulated and shouldn’t undermine the objectives of common prosperity.

The pledges by top leaders came as omicron virus outbreaks continue to spread, with growing fears of a lockdown in Beijing. The capital city tightened COVID requirements over the weekend after more infections were reported following rounds of mass testing of its 22 million population.

Citizens are now required to provide negative nucleic acid test results within 48 hours in order to enter any public venue during the five-day Labor Day holiday. Dining-in at restaurants is banned during the period, and indoor venues including theaters, internet cafes and gyms will suspend operations. The Universal Studios theme park in Beijing also announced it would temporarily close from Sunday to comply with epidemic prevention measures.

In Shanghai, where large swaths of the population have been locked down for a month or more, the government announced on Sunday that six districts met the criteria for zero community spread of COVID-19 and can loosen restrictions. Zero community spread means reporting no local COVID infections for three consecutive days and if the new daily case counts are less than 0.001 per cent of the area’s population for the same period.

As manufacturer to the world, the lockdowns in China mean possible shortages of goods and add another risk to global inflation. Despite repeated calls from the authorities to ensure smooth logistics, container goods were still left sitting at Shanghai’s port for weeks.

“There was plenty of evidence of worsening supply pressures,” Mitul Kotecha, head of emerging markets strategy at TD Securities, wrote in a note. “While there has been some gradual easing in some cities and provinces, manufacturing has struggled due to logistical and supply chain pressures.”

The economy is also losing the one strong pillar that had helped drive its recovery from the 2020 lockdowns. The PMI survey released Saturday showed the new export order sub-index plunged deeper into contraction to its worst level in nearly two years, while the import sub-index was the lowest since February 2020.

Activity is likely to remain depressed throughout the second quarter as virus restrictions are tightened in several places. The fear of widespread outbreaks has ruined the prospect of a bump in consumption during the five-day Labor Day break, which is usually one of the busiest seasons for domestic tourism.

A 7.9 per cent contraction in gross domestic product in Jilin province in the first quarter is also a warning sign on the kind of damage other regions can expect. The northeastern province of Jilin, of which Changchun is the capital, was locked down in March, and restrictions are only now starting to be lifted.

“We remain deeply concerned about growth,” Nomura Holdings Inc. economists wrote in a note. “Despite the raft of policy measures announced by the Politburo meeting, we still believe markets should remain focused on the development of the pandemic and the corresponding Zero COVID strategy. All other polices are of secondary importance.”