Jul 12, 2022

China Offshore Defaults Rise to Record While Local Delinquencies Drop

, Bloomberg News

(Bloomberg) -- A divergence in stress levels between China’s offshore and local credit markets is widening, as defaults on overseas notes hit a record even as calm reigns onshore.

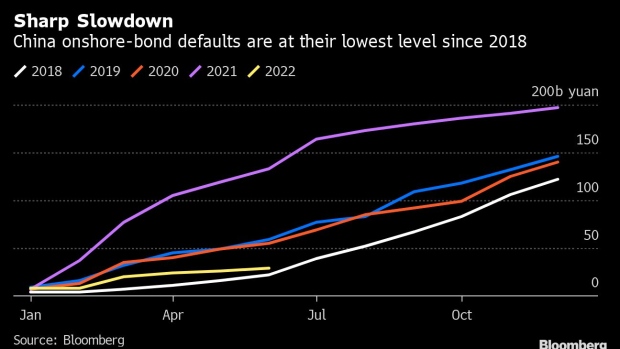

Overseas payment failures have amounted to a record 85% of all Chinese bond defaults so far this year, as measured by the issuance amount, according to data compiled by Bloomberg. In contrast, onshore delinquencies, which had dominated the scene until last year, are at the lowest since 2018 when the data series began.

Chinese firms have missed payments on $26.2 billion of offshore bonds in 2022, with property developers responsible for nearly all that total. As borrowing costs soar, the sector has largely been unable to sell dollar debt this year to refinance notes issued during the past decade’s debt-fueled expansion. Beijing’s “three red lines” policy to slow leverage growth and a slump in new-home sales has crimped many builders’ liquidity.

Defaults on Chinese issuers’ onshore notes have plunged more than 75% to 31.2 billion yuan ($4.6 billion) this year. The domestic calm has been helped by Beijing’s monetary easing, calls for firms to pay their debts and reprieves such as maturity extensions.

The onshore-offshore divergence in stress levels looks set to continue the rest of this year, as Chinese developers face another $31.7 billion of dollar notes maturing, according to Bloomberg-compiled data. Already this month, Shimao Group Holdings Ltd. failed to pay off a $1 billion bond and Ronshine China Holdings Ltd. said it had missed initial deadlines to repay interest for two dollar bonds.

That said, China Evergrande Group’s latest failure to receive investor approval to further delay a local bond payment signals a toughening stance among local creditors, a development that may threaten companies’ ability to seek similar future debt compromise.

©2022 Bloomberg L.P.