US GDP Report Set to Highlight Immigration-Driven Economic Boom

Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

A South Florida office skyscraper from Related Cos. landed new finance tenants, including a John Paulson business and a private equity firm that counts Mark Bezos as a founding partner.

Oracle Corp. is moving its headquarters out of the city. Tesla Inc. is pulling back after a rapid expansion. Almost a quarter of commercial office space is vacant, and nowhere in the country have residential real estate prices fallen further from their pandemic peak.

Mortgage rates in the US increased for a fourth straight week.

It’s independents, a growing voting bloc, who drive election victories in the swing state, where the GOP is rushing to defuse abortion as an issue.

Jul 26, 2021

, Bloomberg News

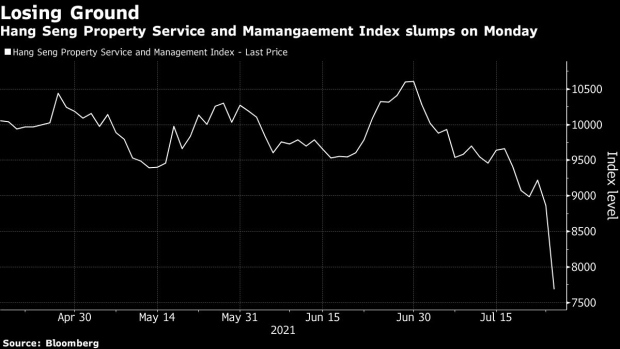

(Bloomberg) -- Chinese property management stocks tumbled on Monday, after Beijing vowed to “notably improve order” in the market and regulate a wide range of industry activities.

The Hang Seng Property Service and Management Index, which tracks Chinese property services companies, slumped as much as 14%, the most since its April inception, poised for a record low. Industry leader Country Garden Services Holdings Ltd. slumped 17% while Shimao Services Holdings Ltd. lost as much as 30% in Hong Kong.

The declines came as a selloff in Chinese private education companies sent shockwaves through the equity market. Investors scrambled to price in the growing risks from an intensifying crackdown by Beijing on some of the nation’s industries, from tech to education and real estate.

Regulators published a statement on Friday afternoon, vowing to step up scrutiny on the property industry. Property management fees not being explicitly revealed, or more fees collected than originally stated, will be banned, according to the statement.

Morgan Stanley downgraded its view on the sector to in-line from attractive, saying the prospect of de-leveraging in the sector will be negative for share performance.

“Continuous de-leveraging may affect developers’ land acquisition capacity and growth outlook, leading to marginal downside risks to property management companies’ contract gross floor area growth,” analysts including Chloe Liu wrote in note.

©2021 Bloomberg L.P.