Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

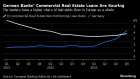

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Aug 25, 2021

, Bloomberg News

(Bloomberg) -- Beijing’s unprecedented determination to curb the property sector could be China’s “Volcker Moment” as it will cause a “significant” slowdown in economic growth, according to Nomura Holdings Inc.

Unlike in previous economic down cycles, Chinese authorities look set to tighten property sector policy and tame prices this time, in order to reduce wealth inequality and boost the falling birthrate, economists led by Lu Ting wrote in a report Tuesday. Policy makers will be willing to sacrifice near-term economic growth to tame house prices and divert financial resources out of the property sector, which accounts for a quarter of China’s gross domestic product, they wrote.

Read more: China Squeezes $1.3 Trillion Revenue Earner to Cool Home Prices

A “Volcker Moment” refers to a policy change like the decision by the Federal Reserve under former Chairman Paul Volcker to quickly raise interest rates to 20% to contain the inflation of the late 1970s. That sudden change caused a jump in unemployment but also led to inflation slowing.

“Markets over the near term need to be prepared for a likely marked growth slowdown, more developer defaults and home foreclosures, and perhaps some turmoil in stock markets,” the economists wrote.

Authorities appear to be determined to expand the property tax scheme from trials in Shanghai and Chongqing cities to the entire nation, according to the report. This will address wealth inequality and help replace local governments’ income from land sales, which will be reduced by the ongoing curbs, the report said.

©2021 Bloomberg L.P.