Jan 13, 2019

China's Big Banks Throw a $22 Billion Test at Hybrids Market

, Bloomberg News

(Bloomberg) -- China’s banks’ urgent want for cash is threatening to overload the country’s fledgling convertible-bond market.

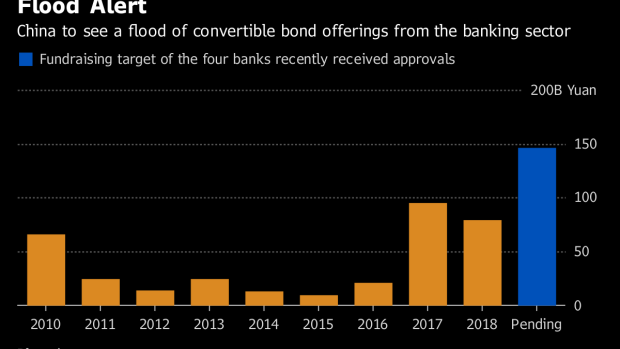

Four lenders are due to sell as much as 146 billion yuan ($22 billion) of the hybrid securities by the end of June after the regulator approved the deals in recent weeks. That includes what could be the largest such offering China’s domestic market has ever seen: Bank of Communications Co.’s 60 billion yuan issue. The fundraising total would be twice the amount raised in all of 2018, data compiled by Bloomberg show.

The issuance comes as Chinese banks beef up their capital buffers to contend with rising defaults and the country’s slowing economic growth. While the recent approvals signal Beijing is expediting lenders’ financing needs, there’s increasing concern that the flood of supply will put pressure on yields. Low equity valuations will also compel buyers to demand higher coupons.

"The sharp increase in new supply will definitely put pressure on the market in the short term, especially in the current risk-aversion environment in the equity market," said Hao Deng, chief executive officer at Beijing GEC Asset Management Ltd. "In the long run, however, the increase of big-cap convertible bonds will help make the market more dynamic and attractive."

In addition to Bank of Communications, Ping An Bank Co., Citic Bank Corp. and Bank of Jiangsu Co. are the other lenders due to issue hybrids. Their stocks all trade at around 0.8 times book value or less.

The China Securities Regulatory Commission has given the green light to another 54 companies to sell convertible bonds. That would take the total tally of upcoming issuance as high as 200 billion yuan, according to data from Northeast Securities Co. as of Jan. 7. The country’s biggest deal yet was Bank of China Ltd.’s 40 billion yuan sale in June 2010.

China has been studying plans to help banks replenish capital, as the country looks to continue with its crackdown on financial risk and shadow banking without hurting credit growth. The recent approvals are seen as the latest sign of the regulator speeding up support efforts.

Capital Shortfall

Central China Securities Co. said in a December note that listed Chinese banks would face core tier-1 capital shortages of 1.6 trillion yuan in three years if they maintain their current levels of capital strength. With slower profit growth and tougher regulatory requirements, banks’ fundraising pressure will mount, analysts led by Liu Ran wrote, adding that they expect the government to provide policy support.

The volume of convertible-bond issuance shrank 17 percent last year as the stock market’s $2.4 trillion rout put a lid on demand. Investors typically bet on convertible bonds for potential gains on the equity conversion, meaning the markets tend to rise and fall in tandem.

Some say higher yields and expectations for a better year in Chinese shares will make the hybrids more attractive in 2019.

"If bond-focused funds want to improve returns this year under such market conditions, they must have an exposure to convertible bonds," said Qian He, a money manager at HFT Investment Management in Shanghai. "Stocks are likely to outperform bonds in the second half."

Still, the flurry of deals and low equity valuations is ensuring this remains a buyer’s market. Wang Junlin, a stocks and derivatives researcher at Beijing Lerui Asset Management Co., said investors are unlikely to snap up new securities from the banking sector unless they’re enticed with higher coupons. Hungry for cash, China’s lenders may be left with little choice.

"There’s a higher possibility banks will offer higher coupons for their convertible bonds due to their needs for capital replenishment," said Wang.

--With assistance from Wei Zhang and Jun Luo.

To contact Bloomberg News staff for this story: Ken Wang in Beijing at ywang1690@bloomberg.net;Jing Zhao in Beijing at jzhao231@bloomberg.net;Yuling Yang in Beijing at yyang329@bloomberg.net

To contact the editors responsible for this story: Richard Frost at rfrost4@bloomberg.net, Sofia Horta e Costa, Sam Mamudi

©2019 Bloomberg L.P.