Mar 8, 2023

China’s Burst of Copper Exports Shows Economy Still Struggling

, Bloomberg News

(Bloomberg) -- China’s copper smelters are preparing to boost exports, a sign its manufacturing and construction sectors aren’t yet making a decisive recovery from the ravages of the past year.

The possibility of a powerful rebound in Asia’s biggest economy has fueled a number of bullish calls on the industrial metal since China exited strict Covid curbs late last year. But an imminent burst of exports from the world’s biggest copper market suggests appetite for the bellwether metal among domestic buyers is still shaky.

At least four major smelters are planning to deliver 23,000 to 45,000 tons of refined copper in total to London Metal Exchange depots in Asia in coming weeks, according to people with knowledge of the sales, who asked not to be identified because the plans are private.

Global copper prices have retreated since reaching a seven-month high in January, partly due to uncertainty over the strength of China’s recovery. The growth target of about 5% for this year — unveiled by the country’s leadership over the weekend — was viewed as a modest goal that won’t deliver a major boost to commodities.

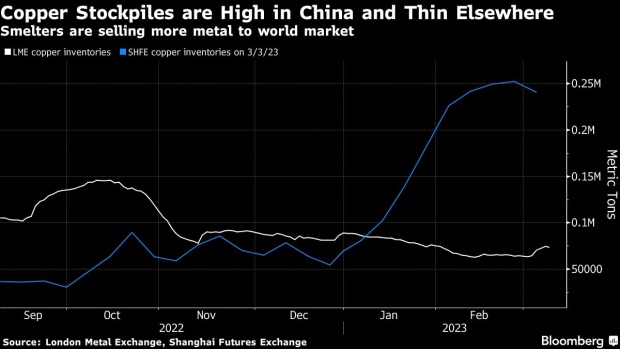

China is a big net importer of copper, but refined metal occasionally flows out in larger volumes when there’s imbalances with the global market. Inventories have been stacking up recently in China, while supply is much tighter elsewhere, and prices are relatively higher. Exchange stockpiles in the rest of the world fell to their lowest since 2005 last month.

“Chinese demand has been lower than expected but it will recover,” said Fan Rui, an analyst at Guoyuan Futures Co. The jump in copper exports could continue into April before Chinese demand eventually picks up, she said.

There are tentative signs that point to stronger metals demand in the country: for example, the nation’s manufacturing index for February notched its highest reading in more than a decade.

The Chinese copper smelters have no clear idea about future exports with the domestic outlook still uncertain for now, the people familiar with their plans said.

Some 13,000 tons of copper that appeared in warehouses in Busan, South Korea this month are from Chinese smelters, one of the people said. The fresh exports are likely to go to LME sheds in South Korea or other Asian locations, and the volumes are in addition to any contracted supplies, the people said.

Copper prices fell 0.7% to $8,850 on the LME as of 10:36 a.m. in Shanghai. They’re down around 1% this month but are still up almost 6% for the year.

The Week’s Diary

(All times Beijing unless noted.)

Thursday, March 9

- China inflation data for February, 09:30

- China to release February aggregate financing & money supply by March 15

- Wilson Center webinar on geopolitics of minerals critical to the clean energy transition

- EARNINGS: CATL

Friday, March 10

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- Mysteel’s Indonesia Nickel Supply Chain Summit in Jakarta

On The Wire

China’s consumer inflation slowed sharply in February as costs of food and consumer goods eased following the end of the Lunar New Year holiday, while factory prices continued to decline.

The US should scrap decade-old import tariffs on solar power equipment after years of protectionism has failed to boost its domestic manufacturing base, according to the chairman of a top Chinese clean energy firm.

©2023 Bloomberg L.P.