Sep 4, 2022

China’s BYD Jumps to No. 2 in Global Electric-Car Battery Market

, Bloomberg News

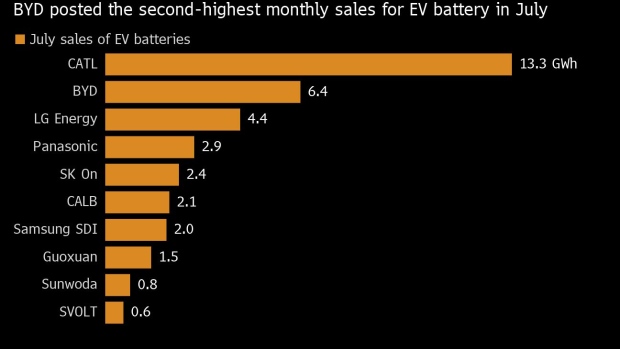

(Bloomberg) -- BYD Co. jumped to second place in global electric-car battery rankings in July, overtaking LG Energy Solution Ltd. as China’s demand for clean cars surges.

The Chinese car and battery maker supplied 6.4 gigawatt-hours of batteries in July, behind only giant Contemporary Amperex Technology Co. with 13.3 GWh. LG Energy slipped to third with 4.4 GWh, followed by Japan’s Panasonic Holdings Corp. at 2.9 GWh, according to data released by Seoul-based SNE Research on Monday. Global battery sales rose to 39.7 gigawatt-hours in July, up 80% from a year earlier, the report showed.

Read more: China Electric Car Sales Forecast to Hit Record 6 Million

The year-to-date market share rankings were unchanged, with CATL top with 34.7% of the market, followed by LG Energy at 14.2% and BYD third with 12.6%.

Demand for EVs continues to soar as high gasoline prices spur drivers to switch to hybrids and battery-powered cars, and automakers electrify their fleets. Still, EV makers face challenges, with the UK and Germany slashing subsidies, the US pushing to reduce reliance on Chinese minerals and components and surging materials prices pushing up the cost of batteries.

Another Chinese company, China Aviation Lithium Battery Co., or CALB, ranked sixth by sales in July, overtaking South Korea’s Samsung SDI Co.

Chinese firms led overall growth in the EV battery industry in July, while the total market share of South Korea’s three battery makers -- LG, Samsung and SK -- declined to 25.9% from 34.2% a year ago, SNE said.

Chinese battery makers appear to be sustaining their pricing power amid tight supply, while China’s battery usage is expected to almost double this year on surging sales of new-energy vehicles, according to Bloomberg Intelligence. South Korean battery makers, meanwhile, need a new strategy to counter subsidies for EVs like new US rules that favor American-made electric vehicles and batteries, and rising “skepticism” over EVs in Europe, SNE said.

©2022 Bloomberg L.P.