Mar 27, 2022

China’s Central Bank May Gradually Shift Away From RRR Cuts

, Bloomberg News

(Bloomberg) -- The People’s Bank of China may soon need to move away from using the reserve requirement ratio as a tool to spur liquidity and growth in the economy since it’s already at relatively low levels and is becoming less effective in addressing the structural challenges facing the economy.

That’s the view from several economists, who say China’s central bank will likely adjust the RRR -- or the amount of cash banks must hold in reserves -- more sparingly in future as it transitions to relying on other instruments. And while speculation is growing the PBOC will lower the ratio again, possibly in the second quarter, the outlook beyond that is more uncertain.

“We do believe the space for RRR cut is quite limited now,” said Lu Ting, chief China economist at Nomura Holdings Inc. “RRR cuts as a significant tool of monetary easing will be history soon.”

The PBOC relies on a range of policy instruments to influence interest rates and money supply in the economy, with the RRR seen as a key signaling tool of its monetary stance and a way to provide long-term liquidity to lenders. A drop in the ratio means banks need to park less cash with the PBOC, and can use that money to lend to customers, fueling growth in the economy.

The central bank has been steadily driving down the ratio over the past decade, with the average weighted RRR for all banks plunging to 8.4% from an estimated 21% in 2011. The RRR for major banks has dropped to 11.5% from 21.5% over the period. In the years before 2011, the central bank lifted the RRR to keep overall liquidity under control under huge current and capital account surpluses.

The PBOC has also made a push to promote inclusive finance by cutting the ratio for rural banks down to 5%.

PBOC officials have alluded to the fact that there’s less scope to make significant cuts to the ratio going forward. Governor Yi Gang said in 2019 that the level of Chinese banks’ overall reserves was on par with developed economies, and the room for further cuts was “much smaller than a few years ago.” Deputy Governor Liu Guoqiang echoed those comments earlier this year.

“The current average RRR for financial institutions at 8.4% is not high anymore, whether compared to other emerging markets or our own history. The room for further adjustment has shrunk. But from another perspective, the space still exists even though it’s narrowed, and we can still use it based on the economic conditions and needs of macro policies.”

-- PBOC’s Deputy Governor Liu Guoqiang, during press conference in January

Nomura’s Lu says the ratio will likely become a neutral tool to maintain financial stability after another couple of reductions.

To add liquidity to the financial system, the central bank will likely rely more on its medium-term lending facility, open-market operations and the relending program, said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. In the longer run, the PBOC may need to consider purchasing government bonds to expand the monetary base, he said.

Going forward, “the PBOC will use the RRR cut sparingly, only when it needs to send a strong easing signal,” he said.

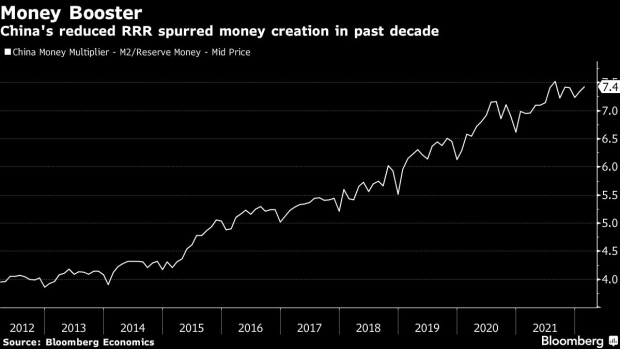

A review of RRR cuts over the years indicates it’s been successful in boosting money creation. The money multiplier -- the ratio between the broadest measure of money in use, M2, and base money created by the PBOC -- shows that each yuan the PBOC injects into the financial system has led to more than 7 yuan in the economy through bank lending, up from just 4 yuan a decade ago.

However, that surge in money supply has also led to imbalances in the economy. Debt has soared, particularly in sectors like property and construction, a problem the government is now trying to address by curbing lending to the real estate market.

Officials want loans to flow to weak areas of the economy, such as to small businesses, or to industries deemed strategically important, like green energy. In order to do that, the PBOC has stepped up the use of targeted tools in recent years and stressed the importance of monetary policy’s “structural function.”

Another challenge that can’t be addressed by a broad measure like the RRR is weak borrowing demand in an economy that’s taking strain from regulatory tightening and Covid controls, said Meng Xiangjuan, an analyst at SWS Research Co.

Without addressing the demand problem, broad liquidity injections through RRR cuts would lead to funds piling up in the financial system without benefiting the real economy, she said.

“Therefore, we believe there’s less need for RRR cuts, and the frequency of RRR cuts has also decreased,” she said.

©2022 Bloomberg L.P.