May 15, 2022

China’s Coal and Gas Power Plummets as Covid Zero Hammers Demand

, Bloomberg News

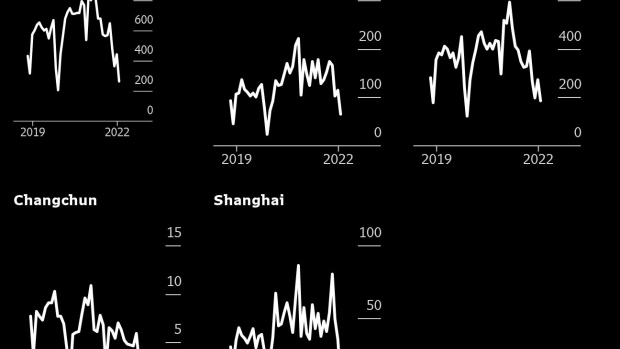

(Bloomberg) -- China’s electricity output plummeted last month as virus restrictions in Shanghai and other parts of the country pummeled economic activity from factory floors to steel mills and shopping malls.

Electricity generation fell in April from the prior month to 608.6 billion kilowatt-hours, a decline of 4.3% on the same period last year. Thermal power output plunged to an even greater degree, down 12% for the biggest drop since 2008, as the share of renewables increased at the expense of coal and gas and China installed more solar capacity than expected in the first quarter.

The moderation in China’s appetite for fossil fuels has come at an opportune time for the world’s biggest energy importer, as well as global markets contending with higher prices resulting from the war in Ukraine. The lower requirement also saw domestic coal, gas and crude output ease from the highs hit in March.

However, the cratering in industrial activity has put China’s growth goals for the year even further out of reach, and among commodities both steel output and oil refining have been hit hard. Although steel production rebounded from March, it was still 5.2% lower on year, while refining activity fell sharply on both measures due to strict mobility restrictions. Aluminum, however, notched a fresh record high as smelters ramped up output to tap elevated margins after the surge in prices following Russia’s invasion of its neighbor.

The monthly read on the economy from the statistics bureau included much worse-than-expected figures for industrial production broadly as well as retail sales, suggesting the impetus for more government stimulus to rescue the economy will only grow. The wish now is that the gradual opening up of Shanghai announced on Sunday will draw a line under the omicron outbreak and allow the tentative signs of recovery in areas like steel and oil refining to take hold without the interruption of further lockdowns. But while Beijing persists with its Covid Zero policy, it’s a fragile hope at best.

Events Today

(All times Beijing unless shown otherwise.)

- Nothing major scheduled

Today’s Chart

Copper and aluminum rose Monday on signs that demand could improve in China, including a reduction in the mortgage rate for first-time home buyers. The central bank didn’t, however, follow-up with a cut to the rate on its one-year policy loans, which will have disappointed some.

On The Wire

- China’s April Apparent Oil Demand Falls 6.7% Y/y

- US Deepens Solar Tariff Probe With 8 Firms Facing Added Scrutiny

- China May Issue 2T Yuan Special Bonds for Infrastructure: Daily

- China’s Huayou Cobalt Restarts Nickel Plate Production

- Global Coal Use May Only Peak Out in 2035, Missing Climate Goals

The Week Ahead

Tuesday, May 17

- Singapore International Ferrous Week, day 1

Wednesday, May 18

- China new home prices for April, 09:30

- Daqing Railway 1Q online earnings call, 15:00

- China’s 2nd batch of April trade data, incl. agricultural imports; LNG & pipeline gas imports; oil products trade breakdown; alumina, copper and rare-earth product exports; bauxite, steel & aluminum product imports

- China April output data for base metals and oil products

- Singapore International Ferrous Week, day 2

Thursday, May 19

- Singapore International Ferrous Week, day 3

Friday, May 20

- China sets monthly loan prime rates, 09:15

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China’s 3rd batch of April trade data, including country breakdowns for energy and commodities

- Singapore International Ferrous Week, day 4

©2022 Bloomberg L.P.