May 25, 2022

China’s Covid Stimulus Isn’t Moving the Needle for Copper

, Bloomberg News

(Bloomberg) -- Copper prices in China have barely budged since the central bank cut interest rates and the government announced 33 measures to rescue the economy from the clutches of its Covid Zero policy.

Given the wide range of copper’s applications, from construction to white goods and renewable power, it might seem odd that such a broad response from the authorities has failed to provoke much enthusiasm among buyers. However, it may be that the bulk of the stimulus, particularly around freeing up lending, has actually been skewed to bandaging Beijing’s self-inflicted wounds in the real estate sector.

And Chinese demand for property is in the deep freeze. While lockdowns or the threat of them persists, buying a new home is probably the last thing on people’s minds.

The government’s efforts to stimulate the property market have become “oversaturated,” said Jia Zheng, a metals trader at Shanghai Dongwu Jiuying Investment Management Co. “There aren’t enough effective policies to bolster the real economy including infrastructure and manufacturing,” she said. “Investors want to see stimulus in things like new energy and the transformation of heavy industry.”

Construction accounts for some 20% of China’s copper demand, according to UBS AG. The other big components are appliances at 18% -- and buying big-ticket consumer goods often accompanies a home purchase -- and electrical infrastructure at 31%.

Events Today

(All times Beijing unless shown otherwise.)

- IEA and Tsinghua University report and webinar on China’s carbon market, 08:30 Paris

- Qingneng hosts webcast on China’s 2022 LNG outlook, 16:00

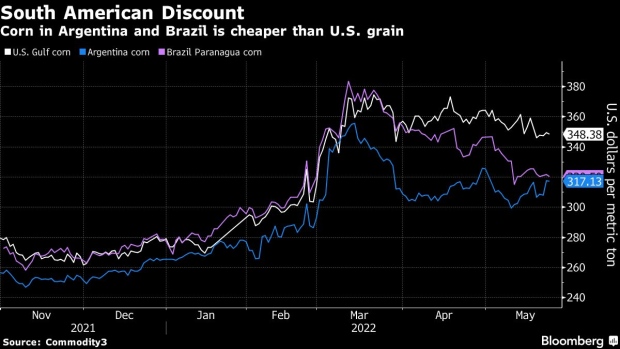

Today’s Chart

Brazil and China have signed an agreement setting sanitary guidelines on corn exports that will guarantee access for Brazilian grain, a move that could threaten the US’s dominance of the Chinese corn market.

On The Wire

- China Builder Zhongnan Warns on Ability to Pay Bonds Due in June

- China EV Stocks ETF Heads for Best Month Since October: Chart

- Peru’s Castillo, Communities Move to Deal on MMG’s Las Bambas

- China Guinea Bauxite Reliance Rises Despite Possible Export Curb

The Week Ahead

Thursday, May 26

- Bloomberg China economic survey for May, 10:00

- USDA weekly crop export sales, 08:30 EST

Friday, May 27

- China industrial profits for April, 09:30

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2022 Bloomberg L.P.