Jan 16, 2020

China’s Credit Growth Holds Up in December

, Bloomberg News

(Bloomberg) -- Sign up for Next China, a weekly email on where the nation stands now and where it's going next.

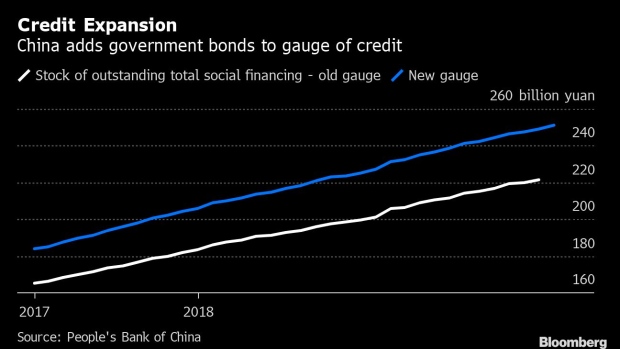

China’s overall credit growth held up in December, according to a reworked gauge of aggregate financing released by the People’s Bank of China.

The stock of outstanding aggregate financing expanded by 10.7% in the month, the same pace as in November, the central bank said Thursday. The previous total financing measure was adjusted to include sovereign and local government debt, the PBOC said. The growth rate refers to an adjusted historical series for the purposes of comparison.

Key Insights

- Financial institutions offered 1.14 trillion yuan of new loans in the month, versus a projected 1.2 trillion yuan, taking the full-year lending to 16.81 trillion yuan compared to 16.17 trillion yuan in 2018

- Broad M2 money supply grew 8.7% in the month from a year earlier

- The stock of outstanding bank loans was 153.11 trillion yuan by the end of 2019, 12.3% larger than a year ago

- Including sovereign and local government debt into aggregate financing can “reflect the intensity of both monetary policy and fiscal policy,” said PBOC spokeswoman Ruan Jianhong. The new gauge can “help improve policy setting and implementation.”

- The uptick in money supply at the end of a year when banks are usually short of credit quota added to evidence domestic demand is recovering amid continuous policy easing and a trade thaw with the U.S. The PBOC has pledged to keep monetary policy flexible in 2020 and keep credit expansion in line with the growth of nominal gross domestic product.

- “We expect further policy easing to be implemented” though the scale of stimulus would be moderate, Wang Tao, chief China economist at UBS Group AG in Hong Kong, wrote in a note before the data. “More details of policy support measures will be announced in the upcoming National People’s Congress meeting in March.”

(Adds chart and PBOC comment.)

--With assistance from Miao Han and Tomoko Sato.

To contact Bloomberg News staff for this story: Yinan Zhao in Beijing at yzhao300@bloomberg.net

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net, James Mayger

©2020 Bloomberg L.P.