Apr 11, 2022

China’s Credit Growth Rebounds Faster Than Expected in March

, Bloomberg News

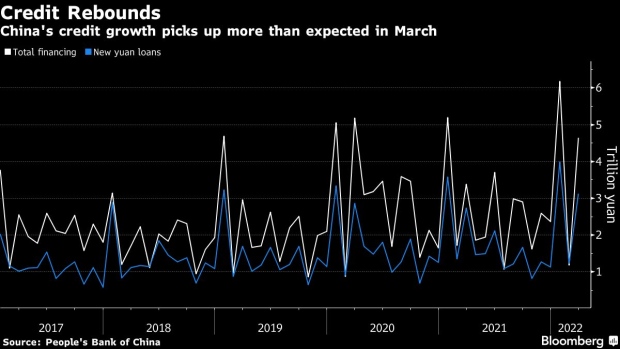

(Bloomberg) -- China’s credit expanded faster than expected in March as economic activity resumed after the Lunar New Year holiday and local governments and companies accelerated bond sales.

- Aggregate financing was 4.7 trillion yuan ($738 billion), the People’s Bank of China said Monday, up from 1.2 trillion in February and compared with the 3.4 trillion yuan a year ago. Economists had projected 3.6 trillion yuan.

- Financial institutions made 3.1 trillion yuan of new loans in the month, up from 1.2 trillion yuan in February. Economists had projected 2.8 trillion yuan.

- The stock of outstanding credit grew 10.6% to 325.6 trillion yuan, accelerating from 10.2% in February

Credit growth in China often picks up in the months following the Lunar New holiday as companies resume operations. Government bond financing has been key to boosting aggregate financing this year, with provinces selling special notes at a record pace to quickly pay for fiscal stimulus. The impulse is likely to stay strong in coming months as local authorities aim to use up their annual bond quota before October.

Officials have made multiple pledges recently to improve monetary support for the economy as the country grapples with its worst Covid wave since early 2020, which has made achieving the government’s annual growth target of around 5.5% more challenging. Those promises have stoked expectations that an interest rate cut could happen as soon as this week.

“The data indicated that quantity-base monetary policy easing is at work and that reduces markets’ concern over the lack of monetary support to offset the downside growth pressures,” said Liu Peiqian, China economist at NatWest Group Plc.

The yield on 10-year Chinese government bond extended the rise after the credit data was released, rising to as as high as 2.78%.

More monetary easing is expected to be rolled out in the short term, with the PBOC likely to adopt tools including the relending program, injections through policy loans and rate cuts in the second quarter, Liu said.

However, questions are also rising over an imbalance in the structure of the credit and how effective the easing measures can be in stimulating credit creation. New short-term loans picked up strongly for both companies and households in March from the previous month, but long-term loans were still lower than their respective levels in the same month last year.

Business and consumer sentiment remain weak because of uncertainty surrounding the Covid situation, a property market slump, and a potential slowdown in global growth as the Federal Reserve hikes interest rates and the war in Ukraine continues.

(Updates with new details throughout)

©2022 Bloomberg L.P.