Jun 10, 2021

China’s Credit Growth Steady in May Following Sharp Slowdown

, Bloomberg News

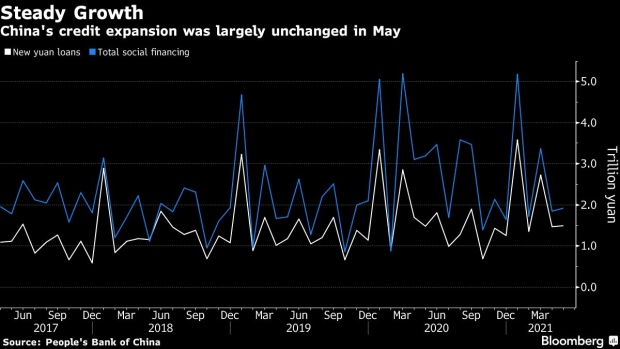

(Bloomberg) -- China’s credit expansion was largely steady in May after a sharp slowdown in the previous month, as the central bank seeks to scale back stimulus in a gradual manner to prevent risks.

- Aggregate financing was 1.9 trillion yuan ($297 billion), the People’s Bank of China said Thursday, unchanged from April and compared with 3.2 trillion yuan in the same month last year. The median estimate in a survey of economists was 2 trillion yuan

- Financial institutions offered 1.5 trillion yuan of new loans in the month, the same amount as in April. Economists projected 1.4 trillion yuan

Key Insights

- The People’s Bank of China has started slowing the pace of credit growth as it seeks to normalize monetary policy now that the economy’s recovery is gathering pace

- “Credit growth is still in a process of tightening gradually,” said Hao Zhou, senior emerging markets economist at Commerzbank AG. The May data shows more steadiness in the policy tightening after the sharp decline in April, he said

- China’s monetary policy will remain stable while consumer inflation is likely to stay below the official target this year, PBOC Governor Yi Gang said Thursday

Get More

- In April, broad M2 money supply grew 8.3%, slightly above the previous month’s pace of 8.1%, which was the slowest since July 2019

- The stock of outstanding credit rose 11%, the slowest pace since February 2020, to reach 298 trillion yuan. The stock of outstanding yuan loans rose to 182.2 trillion yuan

- Shadow banking -- comprising entrusted loans, trust loans and undiscounted banker’s acceptances -- fell 369.3 billion yuan last month

- Net corporate bond issuance contracted by 133.6 billion yuan, the first drop in five months, while government bond financing was 670.1 billion yuan

- For more details of the credit data, click here

(Updates with additional details and comment from economist)

©2021 Bloomberg L.P.