Oct 14, 2021

China’s Economy Is Showing Strain From Property to Energy Crises

, Bloomberg News

(Bloomberg) -- China’s economy is being hit from all sides -- a property slump, energy crisis, weak consumer sentiment and soaring raw material costs -- and government data Monday will show just how bad things are looking.

Economists surveyed by Bloomberg predict a slowdown in gross domestic product growth to 5% in the third quarter from 7.9% in the previous three months, and a weakening in monthly industrial production and investment figures in September. Retail sales may show a pickup after a major virus outbreak was contained.

The outlook for the world’s second-largest economy has darkened in recent months following a worsening in the property market and a shock electricity shortage that forced factories to curb output or shut down completely. Economists have been steadily downgrading their growth forecasts for the year -- some like Nomura Holdings Ltd. predict it could drop to as low as 7.7% -- with ripple effects for the rest of the world.

“It’s not an optimistic picture for the third quarter’s growth, especially as the low-base effect is fading,” said Liu Peiqian, China economist at Natwest Markets Plc in Singapore. “In the third quarter, authorities prioritized longer-term reform goals and were less focused on the short-term growth target.”

Here are some of the key things to watch from the data, which is due for release at 10 a.m. local time on Monday:

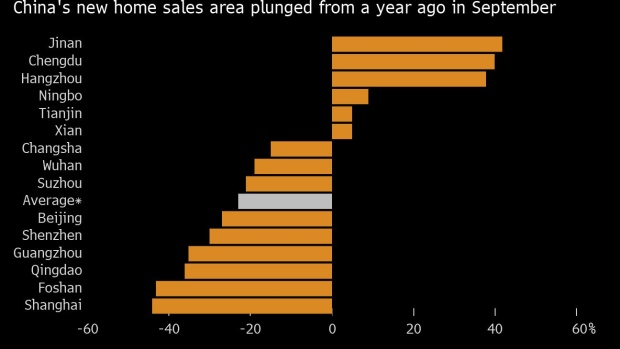

Property Slowdown

Beijing has steadily tightened restrictions on the property market in a bid to curb financial risks, causing a slump in construction and exacerbating a liquidity crisis at developer China Evergrande Group, resulting in a broader spillover in the industry. The combined sales of China’s top 100 developers plummeted 36% year-on-year in September, which is traditionally a peak season for home sales. That will have a knock-on effect on the broader economy, since Goldman Sachs Group Inc. estimates the property sector and related downstream industries make up almost a quarter of GDP.

With strained cash flow, developers are unlikely to splash out on new investment. Growth in real estate investment likely slowed to 9.5% in the nine months through September from a year earlier, down from 10.9% in August, according to economists surveyed by Bloomberg.

Power Crunch

Factories were forced to halt production because of electricity shortages during the second half of September, causing the purchasing managers index to slump below 50 for the first time since the pandemic started last year, a sign of contraction in manufacturing. However, strong export data and rising electricity consumption last month suggest the impact of the power crisis on industrial production may be more mixed.

Electricity consumption in the secondary industry increased 6% year-on-year, implying strong industrial activity despite power outages, Goldman Sachs analysts led by Maggie Wei said in a note. Power usage data can be volatile though, they said, and could deviate from industrial production trends, based on past results. Economists surveyed by Bloomberg predict industrial production growth slowed to 3.9% in September from a year ago, which would match the pace in April 2020. The dataset will also contain monthly output of electricity and other energy products.

Consumer Caution

China has had to deal with its widest Covid-19 outbreak since the virus first emerged in late 2019 after cases of the delta variant began spreading from mid-July. Authorities managed to bring the resurgence under control by the end of September but the country’s stringent zero-tolerance strategy has left a scar on consumption.

Local governments started to relax virus controls since late August, which may have helped retail sales in September. Services sector activity also reported a stronger-than-expected recovery in the month, according to the official purchasing managers’ surveys. Retail sales growth likely accelerated to 3.5% in September from 2.5% in the previous month, according to economists surveyed by Bloomberg.

Booming Exports

Unexpectedly robust export growth in September was one of the few highlights in the economy in a sea of bad news. Appetite for Chinese goods in advanced economies remained strong, partly because overseas buyers have diverted orders from other emerging economies like Vietnam, which have struggled to get delta virus outbreaks under control. Many buyers are also trying to front-load their Christmas shopping orders to cope with global supply chain problems.

The surging trade surplus is one reason why the yuan has continued to strengthen this year even as the growth outlook worsened. Those gains may be starting to worry policy makers now, with the People’s Bank of China setting the yuan fixing at a weaker-than-expected rate on Thursday, prompting the currency to drop from a four-month high.

©2021 Bloomberg L.P.