Dec 7, 2020

China's exports rise most since 2018 as pandemic fuels demand

Bloomberg News

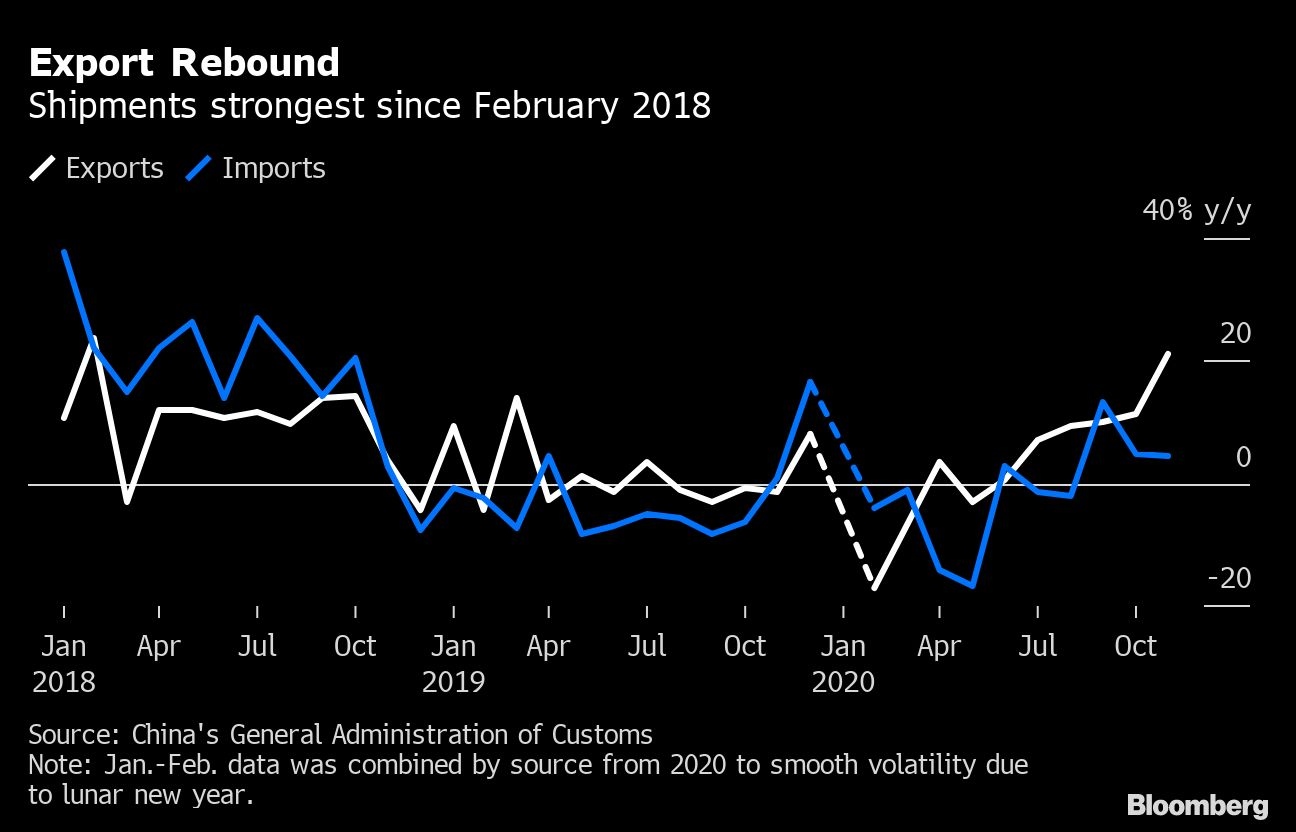

China’s exports jumped in November by the most since early 2018, pushing its trade surplus to a monthly record high and underlining how global demand for pandemic-related goods is supporting a growth rebound in the world’s second-largest economy.

Chinese companies shipped US$268 billion in goods in November, the most for any single month and more than 21 per cent higher than the same month last year. Import growth eased to 4.5 per cent, leaving a trade surplus of US$75.4 billion -- the largest on record in data going back to 1990.

“The export boom is one of the biggest economic surprises this year regarding China’s outlook,” with the country benefiting from effective containment of the virus and strong Christmas orders, said Zhou Hao, an economist at Commerzbank AG in Singapore.

Strengthened by the seasonal surge ahead of the year-end holidays, the figures illustrate how the pandemic has complimented China’s manufacturing strengths, as consumers worldwide reduced spending on services due to coronavirus closures. Combined with a pick-up in China’s domestic consumption and investment, they also suggest that the country’s economic rebound remained on track in November.

“Importers from various locations outside China worried that their locations would be under lockdown during Thanksgiving and Christmas, and therefore request urgent deliveries from China’s factories,” said Iris Pang, Greater China chief economist at ING Groep NV in Hong Kong.

Virus Restrictions

Global demand had started recovering before a resurgence in virus cases in some of China’s biggest export markets, including the U.S. and Europe -- a development which could further fuel demand for Chinese-made personal protective gear and work-from-home devices.

Exports of medical equipment in the January-November period jumped 42.5 per cent in dollar terms from a year ago, while shipments of electronics in November were up 25 per cent compared to the same month last year.

“Demand for pandemic-related and electronics goods was pretty much unaffected by the newly imposed social-distancing measures, which affect services more than goods trade,” said Michelle Lam, Greater China economist at Societe Generale SA in Hong Kong.

What Bloomberg Economics Says...

“Looking ahead, outbound shipments may slow in December due to a higher year-earlier base. But we expect a strong rebound in the pace of increases in 1Q 2021, given the low base in 1Q 2020 when the coronavirus slammed China’s economic activity.”

-- David Qu, China economist

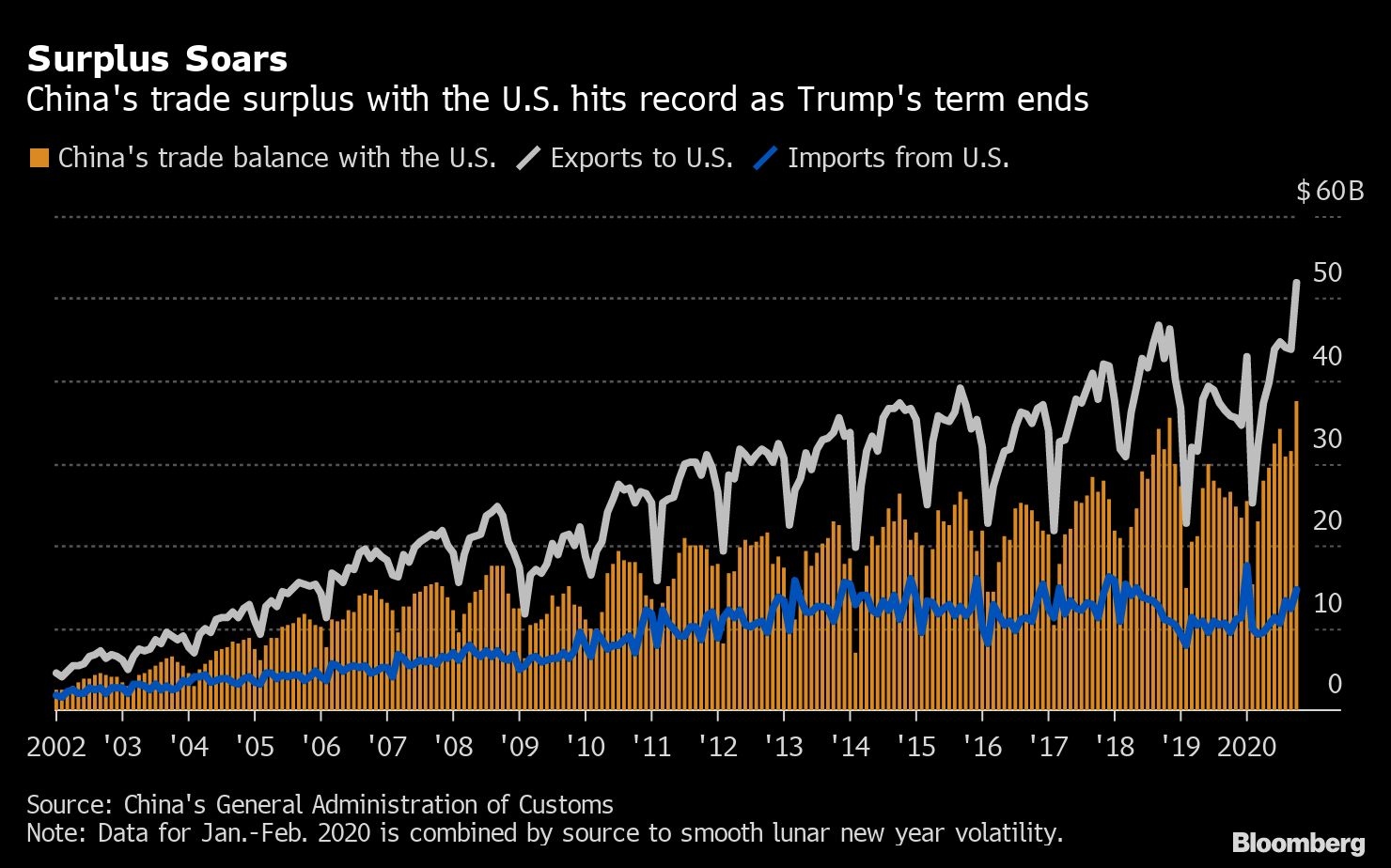

The widening trade surplus could put further upward pressure on the yuan, which has already appreciated more than 6 per cent against the dollar this year, one of the best performers in Asia. Beijing has previously come under attack by the U.S. and Europe because of its currency intervention to weaken the yuan.

“The fact that China’s trade surplus is growing will make everyone unhappy,” said Yukon Huang, a former World Bank head in China who is now a senior fellow at the Carnegie Endowment for International Peace’s Asia Program. “China does not want to rub it in and that’s why it’s been willing to let the renminbi appreciate.”

As a result of changing patterns of trade due to the pandemic, China’s trade surplus with the U.S. reached a new monthly record of US$37.4 billion in November. That’s despite Beijing promising a steep increase in imports from the U.S. this year as part of a phase-one trade deal aimed at halting trade disputes with Washington.

The latest data showed China is nowhere near meeting its targets under that deal. U.S. President-elect Joe Biden recently said that he wouldn’t quickly remove tariffs imposed by the Trump administration and will consult allies before developing a China strategy.

China’s imports tend to be driven by demand for raw inputs for investment and agricultural commodities, rather than consumer goods. Imports of iron ore in the first 11 months of this year rose almost 10.9 per cent from the same period in 2019, while soybean purchases from overseas climbed 17.5 per cent.

“Imports are slightly weaker than expected, which shows that the infrastructure spending might need to take a break as winter is approaching,” said Commerzbank’s Zhou.

Leading indicators of trade, such as freight shipping costs and export orders in Chinese purchasing managers surveys have remained strong, suggesting the solid export performance can be sustained into the new year. South Korea’s exports, a bellwether for global trade, strengthened in November.

However some economists caution that the performance might slow next year if the roll-out of vaccines allows factories elsewhere to return to full capacity.

“We caution that the export strength could temper in 2021 as the recovery in major economies moderates after the V-shaped rebound and production in other countries gradually normalize,” Lam said.

--With assistance from Tomoko Sato.