May 30, 2023

China’s Factory Slump Worsens in Sign of Weak Economic Recovery

, Bloomberg News

(Bloomberg) -- China’s economic recovery weakened in May, raising fresh fears about the growth outlook and prompting calls for more central bank action to counter the downturn.

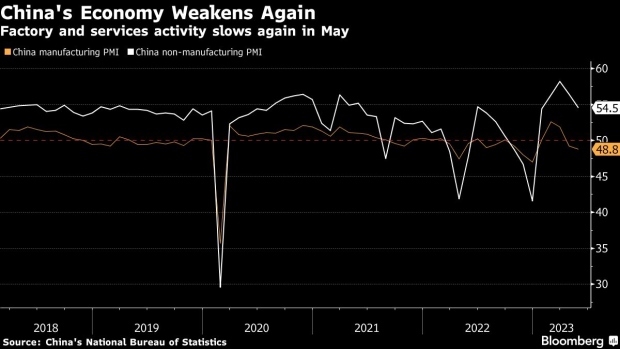

Manufacturing activity contracted at a worse pace than in April, while services expansion eased, official data showed Wednesday, suggesting the post-Covid rebound had lost momentum. Investors sold off everything from Chinese shares and the yuan to copper and iron ore.

China’s economic recovery from the pandemic has been led by consumer spending on services, such as travel and eating out, while manufacturing has lagged. The latest figures from the purchasing managers surveys underscore that uneven pattern, while also raising questions about the strength of consumption in the economy.

“The sharper contraction in the manufacturing PMI suggests that the risk of a downward spiral, especially in the manufacturing sector, is becoming more real,” Lu Ting, chief China economist at Nomura International (Hong Kong) Ltd., and his colleagues wrote in a note.

Calls are getting louder for the central bank to take action, including cutting interest rates or the reserve requirement ratio for banks. While that may give financial markets a lift, it’s unlikely to provide a meaningful boost to consumer and business confidence, which remains subdued. Industrial company profits continue to plunge and global demand is weak.

What Bloomberg Economics Says ...

The weak data underline a lack of confidence in the private sector, and strengthen the case for further policy easing, particularly on the monetary side.

- Chang Shu, chief Asia economist

Read the full report here.

A stronger recovery in China will also depend on a turnaround in the property market, which makes up about a fifth of the economy when including related sectors. Home sales have slowed after an initial rebound, while real estate developers continue to face financial troubles.

Financial markets have been roiled by China’s faltering recovery. A gauge of the nation’s equities listed in Hong Kong slid 1.9% on Wednesday to be the second-worst performer in Asia after the city’s benchmark index. The offshore yuan weakened 0.46% to 7.1239 against the dollar as of 4:14 p.m. local time, extending its loss in May to 2.9%, the most in three months.

Copper futures in London slid, leaving the metal poised for its worst monthly loss in nearly a year. The sharp contraction in China’s steel PMI, which recorded a reading of just 35.2 — the lowest since July 2022 — saw iron ore in Singapore drop as much as 3.3%. Prices of the steelmaking staple recovered later in the session, although they remain below $100 a ton and have unwound all of the gains made since China’s economy reopened.

“We reckon that the Chinese economy could be on the verge of a self-fulfilling confidence trap and believe decisive policy actions are needed,” Citigroup Inc. economists led by Xiangrong Yu wrote in a report after the PMI data release.

The People’s Bank of China will likely cut the interest rate on its medium-term lending facility — a policy loan for commercial banks — by 20 basis points in the remainder of the year, according to Citi, and reduce the reserve requirement ratio for banks by 50 basis points. Fiscal stimulus is limited, though, and “structural” easing measures may be taken by the central government and via state policy banks, the economists said.

The government set a fairly conservative target of around 5% for this year, suggesting it sees limited scope for major stimulus. Economists surveyed by Bloomberg predict growth will reach 5.5% this year.

“There were a lot of pledges on supporting the economy earlier in the year, but none of that is coming to fruition, which is what is most frustrating to me,” said Yang Zhiyong, executive director of Beijing Gemchart Asset Management Co.

Chinese state media on Wednesday cited analysts saying more pro-growth policy measures may be on the cards, including interest rate cuts and more bond sales.

Beijing could also take targeted steps to boost the economy. Officials are considering new tax incentives worth hundreds of billions of yuan for high-end manufacturing companies, according to a person familiar with the discussions.

“China may be heading to a K-shaped recovery, with uneven rebound of manufacturing and non-manufacturing activities in the near term,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc. “Sluggish domestic demand could weigh on China’s sustainable growth, if there are no efficient and effective policy moves to engineer a broad-based recovery.”

--With assistance from Chester Yung, Shikhar Balwani, April Ma and Jason Rogers.

(Updates with additional details.)

©2023 Bloomberg L.P.