Mar 26, 2020

China’s Fresh Green Debt is Drying Up as Virus Batters Economy

, Bloomberg News

(Bloomberg) -- Green financing for Chinese borrowers has slowed to a trickle due to the virus outbreak, threatening the nation’s goals to clean up its environment.

Just one green loan deal was signed for China this year, while green bond issuance saw the slowest start to the year since 2017, Bloomberg-compiled data show, as the country’s firms shift their focus to combating the impact of the coronavirus. This type of debt is used to fund environmental projects including renewable energy or conservation.

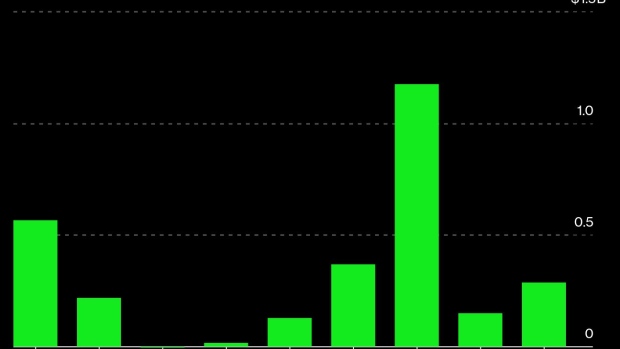

Green loans had become increasingly popular in recent years in China, with volumes surging to an eight-year high of $1.8 billion in 2019 from $306 million in 2017, according to data compiled by Bloomberg which includes local currency loans. Along with a boom in green bond issuance, this kind of financing is a key tool in reducing China’s dependence on dirty fuel and realizing President Xi Jinping’s ambitious environmental policies.

Funding for green projects - the driver for seeking green loans or bonds - is being placed on the backburner while borrowers focus on staying afloat as the pandemic cripples profits. Companies have flocked to take advantage of Beijing’s speedy approvals for sales of so-called “anti-epidemic bonds” that are aimed at easing liquidity for firms hurt by the virus.

“In a crisis context, some companies may have to get support through working capital facilities to finance current fixed operating expenses and may postpone capex investments” for green projects, said Dominique Duval, head of sustainable banking, Asia Pacific at Credit Agricole CIB. This is part of managing liquidity as firms cope with reduced business activity, she added.

To be sure, while the virus hammers businesses in China, regular lenders of green offerings remain focused on the longer term prospects of the market.

“Crises are temporary situations while sustainability considerations are for the long term and here to stay,” said Luca Tonello, head of Asia, global structured finance at Sumitomo Mitsui Banking Corp. Standards for green certification and sustainability for banks and investors remain the same in times of crisis, he said.

Green Resilience

Green financing markets in Taiwan and Hong Kong are more resilient. Taiwanese firms signed off on the equivalent of $3.2 billion of green loans while Hong Kong companies borrowed $355 million in the first three months of 2020, Bloomberg-compiled data show.

Hong Kong-based developer Swire Properties Ltd. has continued on its green foray this year despite the current crisis. The company said it converted HK$2 billion of existing conventional loans into sustainability-linked loans in the first two months of this year.

Fanny Lung, finance director at Swire Properties, does not expect any disruption to the company’s sustainability ambitions as a result of the virus. “We are committed to continuing our sustainable development and green financing initiatives, despite the short-term challenges in the global economy,” Lung said. The firm reported its steepest drop in profits since the Asian financial crisis earlier this month.

Green loans in China have had a slow open this year though Christophe Cretot, head of debt origination and advisory, Asia Pacific at Credit Agricole CIB, expects volumes to continue to increase.

“The Chinese government has given a lot of guidance on becoming more sustainable, so there is a political willingness to do more,” he said.

©2020 Bloomberg L.P.