Jan 18, 2022

China’s Growing Fondness for Bread Will Help Boost Wheat Imports

, Bloomberg News

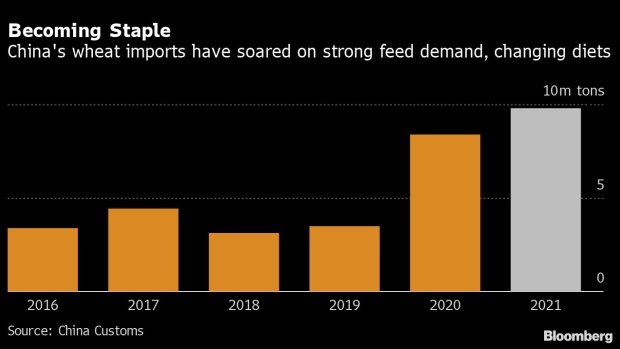

(Bloomberg) -- China will keep scooping up more and more global wheat supplies after record imports last year, with changing diets in an increasingly affluent society set to be a key driver of future demand.

Overseas purchases jumped 17% to about 9.8 million tons in 2021, customs data show. Increased use of wheat for animal feed because of high domestic corn prices and a difficult harvest played a major role in pushing up imports.

But the impact of rising wealth on people’s diets is also boosting demand for the grain, a core ingredient in everything from bread to noodles, dumpling skins, biscuits and pastries. Growth in consumption has accelerated in recent years as China adopts more western-style eating habits, and food use will be the leading driver of wheat demand, according to Sitonia Consulting.

“We’re still expecting China’s 2022 imports to be large,” said Darin Friedrichs, co-founder and market research director of Sitonia, a China-based agricultural information service provider. “Domestic prices remain high due to increased use of wheat in animal feed and structural trends in consumers’ eating habits.”

Strong wheat prices are now starting to rekindle inflation in consumer food staples, with Nissin Foods Co. recently announcing an increase in prices of instant noodles in China. The maker of the famous ‘Cup Noodles’ brand attributed the move, its first in over a decade, to soaring cost pressures.

Today’s Events

(All times Beijing unless noted)

- China Dec. output data for base metals and oil products

- China’s NEA may release 2021 power industry data

Today’s Chart

On The Wire

More than two years into the pandemic most countries are striving to live alongside Covid, accepting the virus as part of everyday life. China, where the pathogen first emerged, exists in an alternate reality, wedded to a zero-tolerance strategy that’s growing harder to maintain.

- BHP Pins 4% Rise in Iron Ore Exports on Supply-Chain Strength

- China’s Iron Ore Imports Likely to Fall in 2022 on Less Demand

The Week Ahead

Thursday, Jan. 20

- China sets monthly loan prime rates, 09:30

- Fengkuang Coal Logistics online market seminar, 15:45

- China’s 3rd batch of Dec. trade data, including country breakdowns for energy and commodities

- USDA weekly crop export sales, 08:30 EST

Friday, Jan. 21

- Bloomberg’s China January economic survey, 10:00

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2022 Bloomberg L.P.