Apr 9, 2020

China’s Inflation Slowed in March as Coronavirus Hurt Demand

, Bloomberg News

(Bloomberg) -- China’s consumer inflation slowed to the weakest pace since October last month as the shutdowns imposed to beat the coronavirus hurt demand.

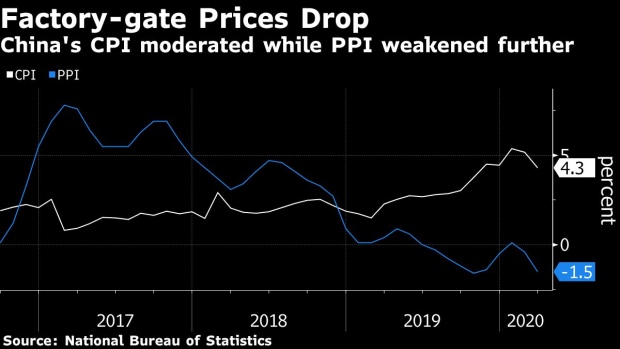

- The consumer price index rose 4.3% in March from a year earlier, the National Bureau of Statistics said Friday. That compares to the median estimate of a 4.9% increase.

- Factory-gate prices declined 1.5%, versus a forecast 1.1% drop.

Key Insights

- Pork prices, a key element in the country’s CPI basket, rose 116.4% on the year.

- Grain prices were flat, according to the release. There have been concerns that other countries could limit exports to ensure domestic supplies during the virus pandemic.

- Core inflation, which removes the more volatile food and energy prices, was at 1.2%

- Consumer inflation could well slow down as pork prices have started falling in recent weeks from record highs and the government has pledged to maintain stable food prices during the pandemic.

- “Improving hog supply combined with a high base will see CPI growth moderating in the future,” Sun Binbin, chief fixed income analyst at Tianfeng Securities Co., wrote in a report before the data was released. “The slump in global demand, the oil price war and a high base from last year will all lead to increased deflationary pressures in April and May.”

- Factory gate prices are already in deflation and the outlook is worsening, which will weigh on manufacturers’ profits and their ability to pay both wages and their debts.

©2020 Bloomberg L.P.