Mar 23, 2022

China’s New Energy Plan Targets a Bigger and More Flexible Grid

, Bloomberg News

(Bloomberg) -- China plans a huge increase in power capacity over the next five years, and will take steps to make its power grid more flexible in order to handle the extra volumes.

The country aims to have 3,000 gigawatts of generating capacity installed by 2025, up from 2,200 at the end of 2020, according its 14th five-year plan for energy development. The 800-gigawatt growth goal is about twice the size of India’s entire power fleet, according to BloombergNEF data.

Much of that will come from renewables, which have the benefit of being carbon-free and incredibly cheap, but the drawback of only generating when wind is blowing and sun shining, a problem for modern economies that want electricity available all the time.

To tackle that issue, China’s planners are upgrading a large part of the country’s coal fleet, about 200 gigawatts in all, to be able to operate as flexible sources and balance the grid when renewable generation wanes. The country is also pushing a massive expansion of pumped-hydro storage facilities, and is continuing to build more long-distance power lines to connect the best renewable areas in the west to the power-hungry cities in the east.

Leaders are also aiming to use more of that renewable power to produce hydrogen, according to a separate document released Wednesday. The goal is 100,000 to 200,000 tons a year of cleanly produced gas by 2025.

That’s enough to triple global green hydrogen output, but it’s just a fraction of the 33 million tons of the gas the country produces now, mostly from fossil fuels. By 2035, China wants to have a full hydrogen ecosystem relying more and more on clean production to help fuel transportation, energy storage and industrial facilities.

Hydrogen is viewed as particularly key to decarbonizing highly polluting sectors like steel and cement-making that are difficult to simply electrify.

Events Today

(All times Beijing unless shown otherwise.)

- Huaneng Power earnings call, 16:00

- Sinofert earnings call, 16:00

- EARNINGS: Maanshan Steel

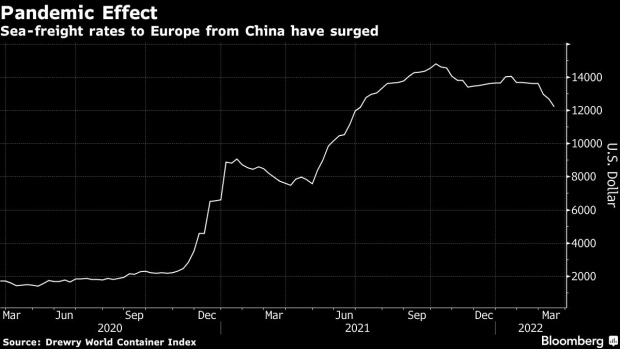

Today’s Chart

More than a million containers set to ride 6,000-plus miles of railway linking Europe to Eastern China via Russia are now having to find new routes by sea, adding to costs and threatening to worsen global supply chain chaos.

On The Wire

China placed its top steelmaking hub under lockdown to control a Covid outbreak, adding to supply uncertainties roiling the global industry and pushing up prices.

More extreme weather caused by rising global temperatures — compounded by geopolitical turmoil and the pandemic — is hindering China’s effort to ensure food supplies for its 1.4 billion population.

The yuan is setting course to depreciate this year as risks to economic growth put an end to two straight years of gains.

- Chinese EV Maker Nio Says It Won’t Be Raising Car Prices Yet

- HKEX Says 1st Carbon Futures ETF H.K. Listing Extends Coverage

- China Local Govt Bond Issuances Double to Drive Growth: Daily

- China Newspaper Sees Room for Further Reserve Ratio and Rate Cut

- U.S., U.K. Reach Deal to Ease Tariffs on Steel and Aluminum

- Covid Curbs Will Affect China Smelters’ Shipments, Not Operation

The Week Ahead

Thursday, March 24

- EARNINGS: China Coal Energy, China Oilfield Services, MMG

- USDA weekly crop export sales, 08:30 EST

Friday, March 25

- Bloomberg’s China economic survey for March, 10:00

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Xinjiang Goldwind, China Shenhua, Jiangxi Copper, Anhui Conch

Saturday, March 26

- Nothing major scheduled

Sunday, March 27

- China 2022 industrial profits through February, 09:30

©2022 Bloomberg L.P.