May 29, 2020

China’s Oil Thirst Draws an Armada of Tankers

, Bloomberg News

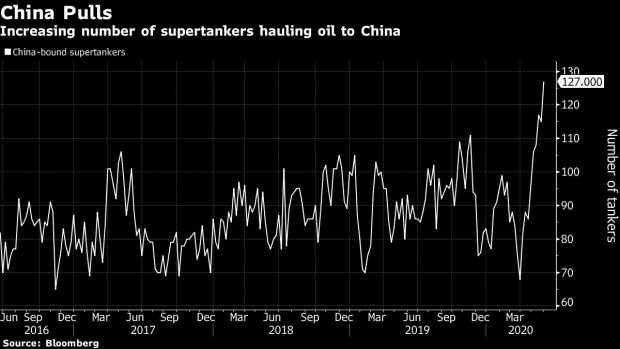

(Bloomberg) -- As Chinese oil demand rises to near pre-coronavirus levels, more and more tankers are hauling crude to the Asian nation from almost everywhere.

The number of supertankers heading to China has jumped to 127, the highest level since at least the start of 2017, and probably ever, vessel-tracking data compiled by Bloomberg show. That amounts to about 250 million barrels of oil, assuming each ship is fully laden.

As the world slowly recovers from the pandemic, oil demand in China is outpacing that in the U.S. and Europe. It’s the natural destination for the glut of crude that is now just starting to dwindle as record output cuts by the Organization of Petroleum Exporting Countries and its allies take hold.

Saudi Arabia’s crude exports to China in May are set to remain above 2 million barrels a day for the second month in a row, even as the kingdom’s overall shipments plummet due to production cuts. While Chinese demand is recovering, the strong Saudi flows are also due to the lingering effects of price cuts for the kingdom’s oil in recent months.

The number of supertankers heading to China, the world’s second-largest oil consumer after the U.S., now surpasses the previous high reached just two weeks ago. Ships are now hauling crude to the Asian country from Brazil, northwest Europe, West Africa and other countries in the Middle East. Many of the shipments will arrive between now and the end of August.

Traders have also booked multiple oil cargoes from the U.S. Gulf Coast to the Far East, according to Clarksons Platou AS analysts including Frode Morkedal. At least six supertankers have been chartered to haul U.S. crude to Asia for June loading, fixture reports compiled by Bloomberg show.

Oil demand in China plunged by about 20% when the country went into lockdown in February to prevent the spread of the virus. It’s now about 13 million barrels a day, just shy of the 13.4 million in May 2019, according to executives and traders who monitor the country’s consumption.

©2020 Bloomberg L.P.