Feb 8, 2023

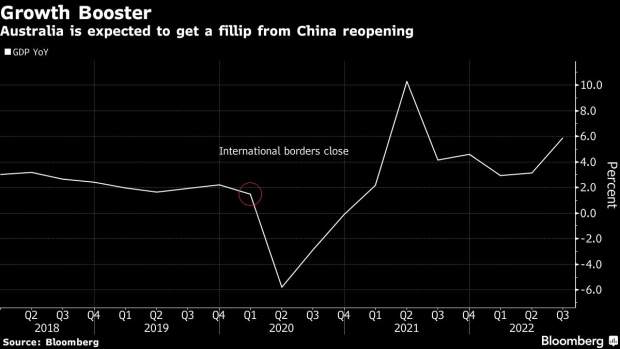

China’s Open Borders Will Lift Australian GDP, ANZ Bank Says

, Bloomberg News

(Bloomberg) -- China’s reopening is expected to raise Australia’s gross domestic product by 0.4 percentage points over the next two years, Australia & New Zealand Banking Group Ltd. said.

An increase in Chinese students and travelers, as well as rising natural gas exports due to an uptick in industrial activity, will drive the growth, ANZ Bank economists said in a research note Wednesday.

At least 50,000 students from China will return to Australia in time for the start of semester one later this month, after the government in Beijing ruled that degrees earned online would no longer be accredited. The swell in arrivals will likely add some relief to Australia’s tight labor market as students fill job vacancies in hospitality services.

“The return of Chinese students to Australia matters to the bottom line, as these students need to find a place to live, buy food and pay bills,” the economists said. “These ‘living costs’ account for 57% of education exports. Tuition fees make up the rest.”

The lift in service exports to Australia’s No. 1 trading partner will provide a much-needed boost to growth amid the highest interest rates in 10 years. That could help the central bank in its difficult task of engineering a soft landing as it battles soaring inflation.

While ANZ Bank expects an “accelerated return” of Chinese visitors, it’ll be a few years before numbers fully recover due to the high costs of travel and delays in processing passports and visas, according to the note.

Stronger industrial activity in China will increase demand for liquefied natural gas exports, though there will be limited upside for iron ore amid the ongoing property slump, the economists said.

©2023 Bloomberg L.P.