(Bloomberg) -- China’s provincial authorities are expecting their economies to expand at least 5% this year, providing clues on where the national government will set its growth target in coming months.

All but one of the 31 provinces have now announced their 2022 growth goals, with Beijing city the lowest at above 5% and the southern island of Hainan the highest at 9%. Local authorities are generally more ambitious in setting objectives than the central government, which usually publishes a target for annual gross domestic product growth in March when the National People’s Congress meets.

With an important political transition coming up later in the year, authorities have already made clear their goal this year is for economic ‘stability,’ but a housing-market crisis and weak consumption and investment are making that more difficult to achieve. The central bank has started to ease monetary policy and the provinces are being told to borrow and spend on infrastructure to support growth.

Economists expect leaders to set a floor for economic growth of 5% for 2022 as the government tries to balance a desire to rein in the real-estate sector with the need for stability.

Rich provinces such as Shanghai, Zhejiang and Guangdong all set targets of around 5.5% or 6% after a robust expansion last year, while Beijing said the virus was “the biggest uncertainty” and domestic demand “remains weak.” The rust-belt northeastern provinces of Liaoning, Jilin and Heilongjiang, whose economies have long been among the weakest in the country, set targets of at least 5.5%.

Hainan was confident in maintaining momentum with support from favorable policies and its aim to build the world’s largest free trade port. The island’s 11.2% expansion last year was the second-fastest rate in the country, after the 12.9% growth of Hubei, whose economy rebounded from a slump in 2020 caused by the lockdown of its capital Wuhan.

The two provinces are among nine regions that aim to grow their economy by 7% or more this year. Tianjin is yet to announce it’s plans.

While China’s economy grew 8.1% last year, the momentum slowed each quarter as plunging home sales damped investment and Covid-related curbs constrained consumer spending. Policy makers have shifted to a pro-growth stance and ratcheted up calls for stability, as the Communist Party prepares for a once-every-five-years meeting in autumn at which President Xi Jinping is set to secure a third term as leader.

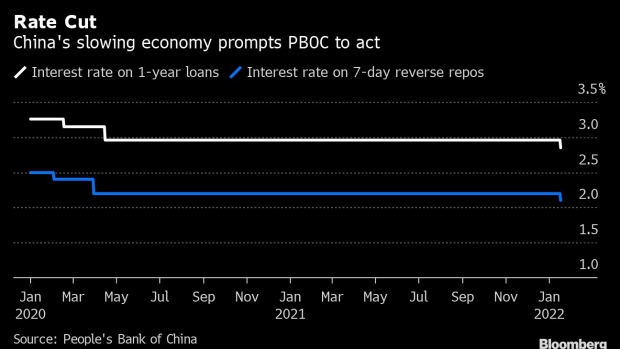

The central bank cut its policy interest rate for the first time in almost two years last week and has pledged to use more monetary policy tools to spur the economy and expand credit. In response, commercial banks last Thursday lowered the country’s de facto lending costs.

Chinese authorities are looking to accelerate investment in infrastructure to drive growth. The State Council, China’s cabinet, last week unveiled a blueprint for developing the nation’s transport network, with targets suggesting a more than 30% jump in the length of high-speed rail lines over the five years through 2025, and a 12% increase in the number of civilian airports.

©2022 Bloomberg L.P.