Sep 26, 2021

China’s Recovery Is Coming Under Pressure From Weak Demand

, Bloomberg News

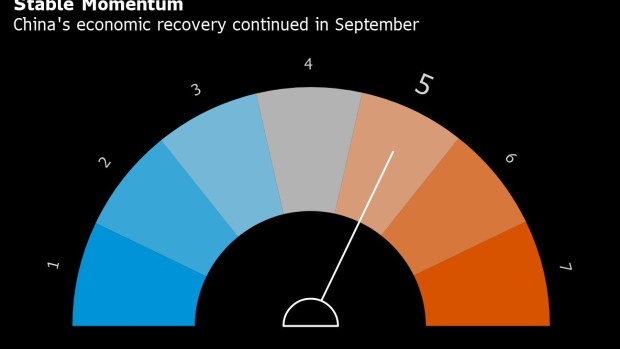

(Bloomberg) -- China’s economic momentum remained stable in September but domestic spending is weakening amid stringent virus control measures and tightening curbs on the property market.

That’s the outlook from Bloomberg’s aggregate index of eight early indicators, which stayed unchanged in September for a fifth month.

The knock to the economy in August from delta virus outbreaks and a pullback in the property market likely lasted through September. China introduced tougher new curbs on travel to squash virus cases from late July, resulting in a marked slowdown in retail sales spending last month. Fresh outbreaks earlier this month disrupted holiday spending during the mid-autumn festival in September and puts a damper on the upcoming national day holiday break.

Authorities have also tightened restrictions in the property market to curb financial risks, reducing funding access for real-estate developers, and slowing the pace of mortgage lending to home buyers.

Home sales slowed further in the nation’s top tier cities in September, signaling that regulatory tightening and an escalating crisis at the country’s most indebted developer are hurting buyer sentiment. Car sales also cooled further, partly as constraints including chip shortages continued to hurt output.

Global demand also showed signs of weakening this month after staying surprisingly resilient in August. South Korean exports, a barometer of world trade, rose 22.9% in the first 20 days of September from a year earlier, down from 41% in August’s preliminary report.

Factory-gate inflation likely trended higher this month, with a set of data tracked by Bloomberg surging to the highest level since the peak in June. Commodity prices continue to boom, adding to inflation pressure, while surging power demand and production cuts in coal and steel to meet emissions targets drive costs higher.

The widening gap between consumer and producer price inflation is adding to the financial pressure of companies, especially smaller ones, who aren’t able to pass on higher costs to households.

Confidence among small and medium-sized enterprises improved marginally in September on better credit conditions, but the growth momentum indicator moderated for a third straight month on weakening new orders, according to a survey of more than 500 companies by Standard Chartered Plc.

“Performance sub-indices for manufacturing and services sectors eased due to weaker domestic demand,” Standard Chartered’s economists Hunter Chan and Ding Shuang wrote in the report. However, the expectations sub-index for the manufacturing and services sectors diverged, with that for manufacturing edging down and services improving in September.

Early Indicators

Bloomberg Economics generates the overall activity reading by aggregating a three-month weighted average of the monthly changes of eight indicators, which are based on business surveys or market prices.

- Major onshore stocks - CSI 300 index of A-share stocks listed in Shanghai or Shenzhen (through market close on 25th of the month).

- Total floor area of home sales in China’s four Tier-1 cities (Beijing, Shanghai, Guangzhou and Shenzhen).

- Inventory of steel rebar, used for reinforcing in construction (in 10,000 metric tones). Falling inventory is a sign of rising demand.

- Copper prices - Spot price for refined copper in Shanghai market (yuan/metric tonne).

- South Korean exports - South Korean exports in the first 20 days of each month (year-on-year change).

- Factory inflation tracker - Bloomberg Economics created tracker for Chinese producer prices (year-on-year change).

- Small and medium-sized business confidence - Survey of companies conducted by Standard Chartered.

- Passenger car sales - Monthly result calculated from the weekly average sales data released by the China Passenger Car Association.

©2021 Bloomberg L.P.