Jun 18, 2019

China's Running Out of Cold Storage as It Stocks Up on Imported Pork

, Bloomberg News

(Bloomberg) -- China’s scramble to import as much meat as possible to compensate for the drop in pork supply from a pig-killing disease has left it with a big problem: Cold storage space at its major ports is running out.

Importers have stockpiled a large amount of meat -- mostly pork and beef -- and chilled storage at ports including Tianjin, Shanghai and Dalian is now almost full, said Wang Zhen, an official at China’s Cold Chain Logistics Subcommittee, an industry group.

The meat is likely to be stored at the ports through to the end of the year in anticipation of the country’s peak consuming season, Wang said. Fresh sizable shipments will have to wait until buyers can find storage place, she said.

“Importers are trying to move the meat to inland areas to store it, but it’s more expensive as they plan to store the meat for months until mid-autumn or spring festivals,” Wang said. Inland storage facilities are only for temporary use, and costs are higher than those at ports, she said.

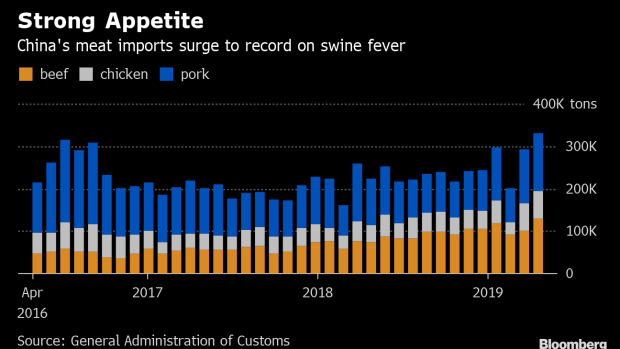

The lack of capacity may limit opportunities for global meat producers, who have been working to strike export deals with China. The U.K., Germany, Russia and India are just some of the countries that are seeking to sell China more meat, while shipments from poultry-giant Brazil have surged this year. China bought a record amount of meat in April as African swine fever causes the slaughter of million of hogs in the world’s biggest pork market.

Tianjin Zhongyu Real Estate Co., the largest storage facility operator in the Tianjin area, said cold space at some major ports are almost fully occupied. In Tianjin alone, about half a million tons of meat is in cold storage.

Queue Up

Large meat shipments to China may need to wait to find space until domestic meat price rise further or until September or October, when some of the stored meat may be sold, said Cao Guoliang, an operation manager at Zhongyu.

“Most of the importers bought the meat in March and April, and they are likely to release the stocks when they see a profit of say 3%-5%," said Cao. Current prices are not profitable for them to sell, he said. Lean hog futures in Chicago had surged to the highest in five years in April, but have since fallen 17%.

Brazil’s pork exports to China surged 51% year-on-year in May, while chicken shipments jumped 49%. China also lifted a temporary ban on Brazilian beef that had been adopted after a case of mad cow disease was reported in the Latin American country.

China’s pork prices are likely to surge to a record in the second half of this year as farmers hold off on restocking their herds for fear of swine fever.

--With assistance from James Mayger.

To contact Bloomberg News staff for this story: Niu Shuping in Beijing at nshuping@bloomberg.net

To contact the editors responsible for this story: Anna Kitanaka at akitanaka@bloomberg.net, Andrew Hobbs

©2019 Bloomberg L.P.